Stocktwits sentiment for KMB shifts to ‘extremely bullish.’

- Kimberly-Clark shares declined marginally in the premarket session on Tuesday, after a sharp drop the previous day.

- The company announced on Monday that it is buying Kenvue for an enterprise value of $48.7 billion, despite risks from U.S. administration claims that Tylenol pain medicine raises the risk of autism when taken during pregnancy.

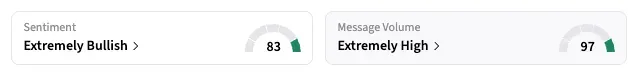

- Stocktwits sentiment for KMB shifts to ‘extremely bullish.’

Shares of Kimberly-Clark Corp. declined 0.3% in early premarket trading on Tuesday, after Monday’s steep drop triggered by the company’s $48.7-billion deal to acquire Band-Aid maker Kenvue, Inc.

The deal surprised many investors, coming just weeks after U.S. President Donald Trump claimed that acetaminophen, the active ingredient in Kenvue’s Tylenol pain reliever, causes a higher risk of autism when used during pregnancy. Although Kenvue staunchly denied those claims, the U.S. administration’s position led to a wide sell-off in the company’s stock at the time.

Now, early commentary from analysts and retail investors shows a broadly positive position on the deal.

Analysts Upbeat Over Long-Term

In an investor note, Jefferies analysts described the deal, which values KMB at $3.50 per share in cash and 0.14625 KMB shares, as “an attractive price for a solid portfolio of well-known brands.” They, however, said that more suitors could emerge for Kenvue.

Kimberly-Clark’s acquisition would create a consumer goods giant, bringing together brands like Huggies and Kleenex with the likes of Band-Aid and Tylenol. Kenvue spun out of Johnson & Johnson in May 2023.

RBC Capital Markets analysts said the deal will positively diversify Kimberly-Clark’s portfolio, although “the timing is earlier than we expected,” according to a Reuters report.

What Is Retail Investors’ View?

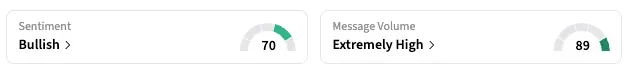

On Stocktwits, the retail sentiment for KMB shifted to ‘extremely bullish’ as of early Tuesday, up from ‘bullish’ the previous day, while that for KVUE moved a few points higher in the ‘bullish’ zone.

“$KMB a lot of stupid reactions to the deal announcement, mostly based on the idea that Kenvue is radioactive due to potential Tylenol liability. Some of us think that risk is grossly overstated, and the absurd non-scientific claims about Tylenol and autism will never meet the standard required for tort damages in a class action lawsuit or even an individual lawsuit,” a user said.

“I think KMB is generationally cheap at the current level, and represents a screaming buy.”

Kenvue’s shares declined 0.3% in Tuesday’s premarket session, after rising 12.3% on Monday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<