As part of the agreement, the U.S. Department of War will also receive warrants in ReElement Technologies

- Unit ReElement Technologies signs a $1.4 billion deal with the U.S. Department of War and Vulcan Elements

- Goal is to establish a fully integrated domestic supply chain for rare earth magnets

- OSC will provide two loans matched by private capital – $620 million to Vulcan Elements and $80 million to ReElement Technologies

Shares of American Resources Corporation (AREC) gained 16% in early trade on Monday after its unit ReElement Technologies Corporation signed a $1.4 billion deal with the U.S. Department of War’s Office of Strategic Capital (OSC) and Vulcan Elements.

The goal of the deal is to establish a fully integrated domestic supply chain for rare earth magnets. The agreement expands ReElement’s collaboration with Vulcan and enhances federal support for strengthening the U.S. critical minerals sector.

In August, Vulcan Elements and ReElement Technologies signed a commercial-scale offtake agreement for light and heavy rare earth oxides.

What Does The Deal Entail?

Under the arrangement, the OSC will provide two loans, matched by private capital, totaling $700 million: $620 million to Vulcan Elements and $80 million to ReElement Technologies. The funding will boost the companies’ capabilities in rare earth element separation, metallization, and magnet manufacturing, supporting a production capacity of up to 10,000 metric tonnes of Neodymium Iron Boron (NdFeB) magnets.

This initiative is expected to narrow the U.S. supply gap in rare earth magnet production, a key material for defense, renewable energy, and electric vehicle industries.

As part of the agreement, the U.S. Department of War will also receive warrants in ReElement Technologies. The loans are funded through a federal initiative enacted in July 2025, which authorizes up to $100 billion in lending to advance domestic production of critical minerals and related technologies.

The Rare Earth Standoff

Rare earth elements are a key factor in the ongoing “tariff wars” between the U.S. and China. The dragon controls roughly 70% of global rare earth mining and nearly 90% of processing capacity, giving it substantial influence over the sector. Any disruption in the supply chain causes significant damage to key manufacturing sectors.

However, after a crucial meeting between Chinese Premier Xi Jinping and U.S. President Donald Trump last week, China announced plans to pause its restrictions on rare-earth exports.

Despite the development, the White House has stepped up its efforts over the past months to increase domestic production of critical minerals. The U.S. has taken stakes in companies such as Lithium Americas, MP Materials, Critical Metals, and Trilogy Metals. The White House has also stated that it is in talks with many other companies over potential stakes.

What Are Retail Investors Saying?

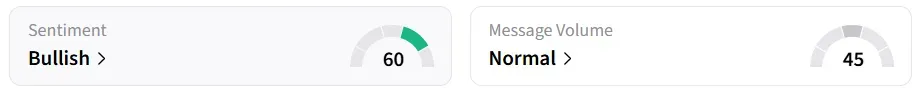

Retail sentiment on Stocktwits flipped to ‘bullish’ from ‘bearish’ a day earlier.

One user believes AREC’s stock could climb to $50.

The stock has more than quadrupled in value so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<