Earlier this week, Visa said its quarterly global payments volume, a gauge of overall consumer and business spending on its network, jumped 9% on a constant-dollar basis.

- On an adjusted basis, Wall Street expects the payments giant to post earnings of $4.31 per share on revenue of $8.53 billion.

- On Wednesday, Fortune magazine reported that the company is in late-stage talks to buy the crypto and stablecoin infrastructure startup Zerohash for between $1.5 and $2 billion.

- Mastercard’s rivals, Visa and American Express, have both recently unveiled upbeat annual forecasts, driven by resilient consumer spending.

Mastercard (MA) stock edged lower in premarket trading on Thursday ahead of its quarterly earnings report.

On an adjusted basis, Wall Street expects the payments giant to post earnings of $4.31 per share on revenue of $8.53 billion, as per Fiscal.ai data. The company has topped estimates in all four previous quarters.

Mastercard Nearing $2B Deal For Zerohash In Stablecoin Push — Report

On Wednesday, Fortune magazine reported that the company is in late-stage talks to buy the crypto and stablecoin infrastructure startup Zerohash for between $1.5 and $2 billion.

The Chicago-based Zerohash, established in 2017, specializes in stablecoin and blockchain infrastructure. Their offerings include facilitating payments and crypto trading.

The rumored talks come amid a surge in interest in stablecoins, typically pegged one-to-one to currencies such as the dollar, which enable consumers to pay merchants directly from their cryptocurrency wallets. This method bypasses traditional banking instruments and provides instant settlement.

What Are Analysts Saying?

Mastercard’s rivals, Visa and American Express, have both recently unveiled upbeat annual forecasts, driven by resilient consumer spending despite the Trump tariffs. Earlier this week, Visa said its global payments volume, a gauge of overall consumer and business spending on its network, jumped 9% on a constant-dollar basis for the fiscal fourth quarter.

According to TheFly, Citi analysts said last week that Mastercard, which plays a “major role” in facilitating high take-rate cross-border transactions and has “consistently shown a proclivity to innovate,” presents a “compelling investment case” as a major network service provider.

However, in a broader sector note, Truist analysts had warned that some firms might announce lower fourth-quarter earnings forecasts following a strong holiday season last year.

What Is Retail Thinking?

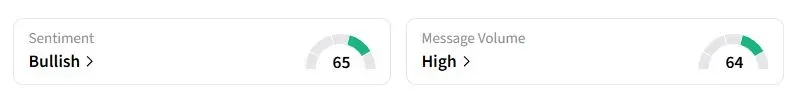

Retail sentiment on Stocktwits about Mastercard was in the ‘bullish’ territory ahead of its earnings.

Mastercard stock has gained 4.8% this year, underperforming both the S&P 500 and Nasdaq 100 indices.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<