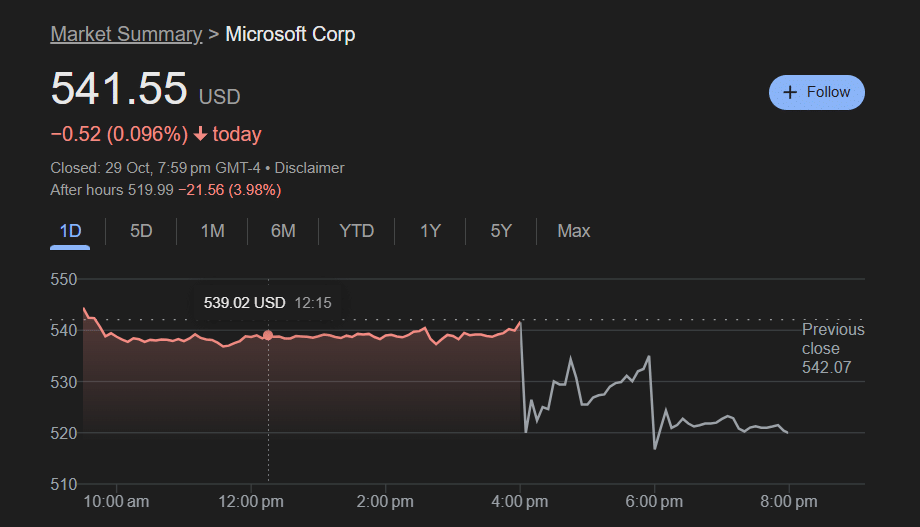

New Delhi: Microsoft kicked off its financial year on a high note, posting strong quarterly earnings even as a major Azure outage briefly disrupted its cloud and productivity services. The results came just a day after its latest deal with OpenAI pushed the company’s valuation beyond $4 trillion, making it the most valuable firm in the world.

The tech giant reported first-quarter earnings of $3.72 per share, slightly above Wall Street’s expectation of $3.68. Revenue touched $77.7 billion, compared to $65.6 billion in the same period last year. Net income rose to $27.7 billion from $24.67 billion a year ago. The results showed that despite service hiccups and rising AI costs, Microsoft’s growth engine remains strong.

The company took a $3.1 billion hit from its growing investment in OpenAI.

Azure outage fails to dent growth

Microsoft’s results came just hours after its cloud platform Azure and Microsoft 365 services suffered disruptions worldwide. “We are working to address an issue affecting Azure Front Door that is impacting the availability of some services,” the company said in a statement.

Yet, the outage barely slowed Azure’s momentum. The cloud business grew by about 40%, surpassing analyst estimates and reinforcing its position as Microsoft’s biggest growth driver. Operating income jumped 24% to $38 billion, powered by global demand for AI-driven cloud tools and enterprise solutions.

CEO Satya Nadella described Microsoft’s ecosystem as a “planet-scale cloud and AI factory,” saying it is “driving broad diffusion and real-world impact.” He added, “It’s why we continue to increase our investments in AI across both capital and talent to meet the massive opportunity ahead.”

$3.1 billion OpenAI hit weighs on earnings

A large part of Microsoft’s spending this quarter was tied to its deepening partnership with OpenAI. The company took a $3.1 billion hit to net income, leading to a 41-cent decline in earnings per share.

The relationship with OpenAI, which began in 2019, has become one of the most influential partnerships in the technology sector. Nadella called it “one of the most successful partnerships and investments our industry has even seen,” adding that both companies “continue to benefit mutually from each other’s growth across multiple dimensions.”

As part of the new recapitalization agreement, Microsoft now holds a 27% stake in OpenAI Group PBC, valued at roughly $135 billion, while the non-profit OpenAI Foundation controls a $130 billion stake in the for-profit entity.

AI spending surges 74% year-on-year

Microsoft’s AI investments show no signs of slowing down. The company spent $34.9 billion this quarter on AI-related projects, a 74% increase from the same period last year. This includes work on AI infrastructure, Copilot tools, and cloud-based AI systems.

Nadella said the company is focused on building AI systems that work “across high-value domains” such as enterprise, productivity, and cybersecurity.