AI chipmaker Nvidia has made history, becoming the world’s first $5 trillion company. Backed by booming AI demand, record deals, and investor confidence, the California-based tech giant has now outpaced Apple and Microsoft in market value.

In a moment that will be remembered as a turning point in the history of technology, AI chip juggernaut Nvidia has officially become the world’s first $5 trillion company. The California-based giant crossed this staggering valuation on Wednesday as its stock surged 4.91% to $210.90 when trading opened on Wall Street. That valuation — greater than the GDP of France or Germany — also surpasses the combined market worth of Tesla, Meta (Facebook), and Netflix. With this, Nvidia has not just outpaced its rivals but has also rewritten the playbook of modern capitalism.

Racing Ahead in the AI Revolution

The record-breaking valuation reflects investor confidence in artificial intelligence as the next great wave of technological transformation. Nvidia’s dominance in AI chips — the beating heart of generative AI systems like ChatGPT — has made it indispensable to the digital world’s infrastructure.

“The company is largely ahead of any competitor who finds it hard to catch up in the world that Nvidia lives in,” said Art Hogan of B. Riley Wealth Management, highlighting the scale of Nvidia’s lead in the AI ecosystem.

Hogan added, “While it’s almost unfathomable to think about a company reaching this milestone, it comes from a company with so many operational efficiencies that seems to announce massive deals on a daily or weekly basis.”

From powering autonomous vehicles and cloud data centers to gaming and AI research, Nvidia’s GPUs have become as essential to the 21st century as Intel’s microchips were to the 20th.

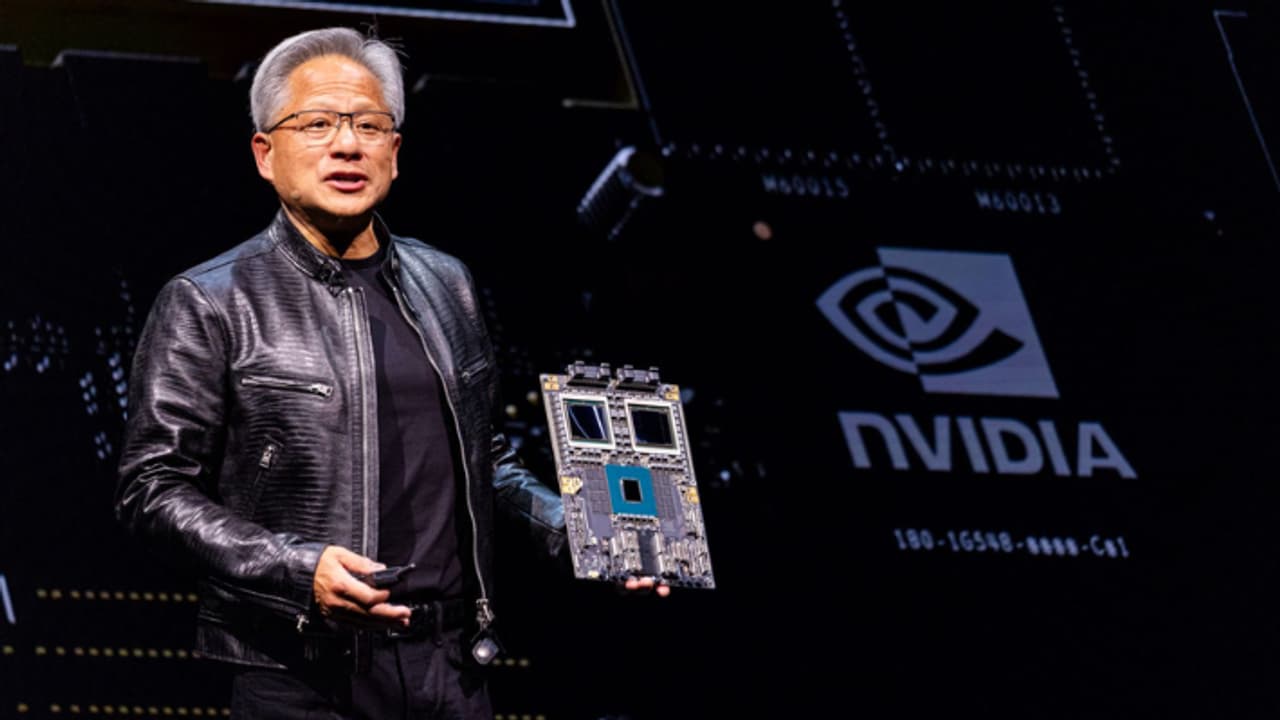

Jensen Huang’s Global Push

At the center of this meteoric rise stands Jensen Huang, Nvidia’s charismatic founder and CEO. The Taiwanese-American entrepreneur, known for his trademark leather jacket and quiet confidence, is now arguably the most influential figure in the AI hardware industry.

Huang is set to visit South Korea this week, where he will appear on the sidelines of the APEC summit — a crucial diplomatic event expected to feature discussions on AI regulation and cooperation. There, US President Donald Trump is scheduled to meet Chinese President Xi Jinping, with AI expected to feature high on the agenda.

Navigating US-China Trade Tensions

Despite its triumph, Nvidia’s relationship with China remains fraught. The company’s chips are currently banned in China, a consequence of mounting national security concerns and Washington’s tightening export controls.

The Trump administration has signaled a more “nuanced” approach toward selling AI chips to Beijing, but faces stiff resistance from China hawks across the US political spectrum who favor stricter bans.

For Nvidia, the possibility of regaining access to China — once its biggest market for data center chips — could unlock yet another chapter of growth.

Big Bets on the Future

Nvidia has spent recent months expanding its reach with a series of headline-grabbing deals. Among them:

- A $100 billion investment plan in OpenAI, the creator of ChatGPT.

- A $5 billion investment in Intel, aimed at boosting domestic semiconductor manufacturing in the United States.

- A partnership with Nokia, announced this week, to power Europe’s next generation of AI-driven communication networks.

These moves align closely with Washington’s push to strengthen US-based tech manufacturing while keeping America at the forefront of the AI revolution.

A Company That Saw the Future Early

Nvidia’s story is a masterclass in foresight. Though it began as a company designing graphics processors for video games, it pivoted in the late 1990s toward GPUs for computing applications. That strategic shift — from gaming to cloud and AI — gave Nvidia a decade-long head start in an industry that’s now the backbone of modern computing.

Although Nvidia was not the first company to develop GPUs, the California-based firm made them its specialty, swiftly pivoting from video games to the then-emerging field of cloud computing.

Is This a Tech Bubble 2.0?

Not everyone is convinced the euphoria will last forever. Analysts have begun comparing the current AI investment frenzy to the dot-com bubble of the 1990s, when speculative bets on the internet led to a dramatic market crash.

Sam Stovall of CFRA Research offered a balanced take: “Nvidia’s expected growth is still very strong and investors should expect news surrounding the company will only get better, not worse.”

But he also warned, “Valuations are elevated… and could therefore be vulnerable to any upsetting news.”

The New Face of Global Power

With Nvidia’s ascent, the global tech hierarchy has been redrawn. Microsoft and Apple, long the undisputed titans of Wall Street, now trail behind at just over $4 trillion each.

Beyond finance, however, the milestone represents something much deeper — the triumph of artificial intelligence as a defining force of this century. From geopolitics to economics, AI is no longer just an innovation; it’s an instrument of power.

As the AI race accelerates, Nvidia’s $5 trillion crown may be both a symbol of human ambition — and a warning of how fast the future is coming.