Auddia saw retail chatter skyrocket 27,900% in 24 hours after the company entered a non-binding letter of intent to pursue a business combination with Thramann Holdings.

The tech-heavy Nasdaq Composite Index closed 0.65% lower at 20,916 on Tuesday, dragged down by overall weakness. Auddia, Match Group, and Snap saw the highest retail chatter on Stocktwits among tech companies in the last 24 hours. Here’s a detailed analysis of how retail responded to the three stocks in the news:

1. Auddia Inc. (AUUD): The AI audio platform saw retail chatter skyrocket 27,900% in 24 hours after the company announced on Tuesday that it has entered a non-binding letter of intent (LOI) to pursue a business combination with Thramann Holdings, LLC, a private firm led by entrepreneur Jeff Thramann.

Retail sentiment around the stock improved to ‘extremely bullish’ (78/100) from ‘neutral’ territory the previous day. Message volume jumped to ‘extremely high’ (97/100) from ‘low’ levels in the last 24 hours.

Auddia stock traded over 13% lower in Wednesday’s premarket.

2. Match Group Inc. (MTCH): The technology company saw retail chatter surge 1,200% in 24 hours after the company reported second-quarter (Q2) earnings on Tuesday.

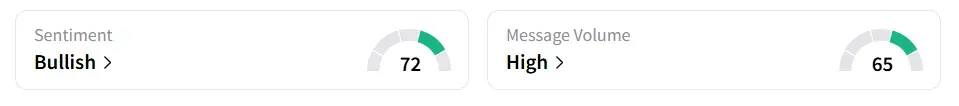

Retail sentiment around the stock improved to ‘bullish’ (72/100) from ‘neutral’ territory the previous day. Message volume jumped to ‘high’ (65/100) from ‘normal’ levels in the last 24 hours.

The company’s Q2 revenue remained flat year-on-year (YoY) at $864 million, beating the analysts’ consensus estimate of $854.1 million, as per Fiscal AI data. Earnings per share (EPS) of $0.49 missed the consensus estimate of $0.70.

Match Group stock traded over 5% higher in Wednesday’s premarket.

3. Snap Inc. (SNAP): The social media company saw retail message count explode by 1104% in 24 hours after Q2 earnings on Tuesday.

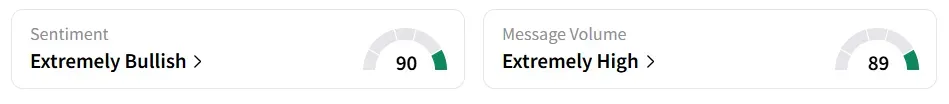

Retail sentiment around the stock improved to ‘extremely bullish’ (90/100) from ‘neutral’ territory the previous day. Message volume jumped to ‘extremely high’ (89/100) from ‘high’ levels in the last 24 hours.

The company reported a loss per share of $0.16 compared to the year-ago loss of $0.15. Revenue rose 9% year-over-year (YoY) to $1.344 billion, roughly in line with the Fiscal AI compiled consensus of $1.345 billion.

Snap stock traded over 17% lower in Wednesday’s premarket.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<