- Domino’s Pizza Enterprises Ltd is in talks to go private in a deal worth A$4 billion ($2.6 billion), the Australian Financial Review reports.

- Domino’s Pizza Enterprises pays royalty and fees to U.S.-listed Domino’s Pizza, Inc.

- Papa John’s was recently approached by Apollo, signaling increased interest from private equity players in restaurant operators.

The operator of Domino’s restaurants in Australia and New Zealand, among 12 countries in Asia-Pacific and Europe, is in talks with Bain Capital to go private, the Australian Financial Review reported on Monday.

The stock was halted for trading on the Australian stock exchange, pending a further announcement.

The deal for Domino’s Pizza Enterprises Ltd. could be worth A$4 billion ($2.6 billion), according to the report. Bain could acquire all or parts of the company and advisors are yet to be formally appointed.

Brisbane, Australia-headquartered Domino’s Pizza Enterprises is the largest master franchisee of Domino’s Pizza, Inc. globally and holds exclusive rights in countries including Japan, France, Germany, Belgium, the Netherlands, Luxembourg, Taiwan, and Cambodia.

How Do Retail Investors View The Deal

Domino’s Pizza, Inc. does not own a stake in Domino’s Pizza Enterprises and earns royalties and fees based on the latter’s sales. Following the report, the company’s shares listed on the Australian Securities Exchange (ASX) jumped 17.4% to trade at A$18.13 in afternoon local time.

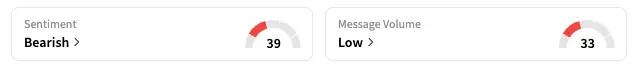

On Stocktwits, the retail sentiment for DPZ remained ‘bearish,’ unchanged over the last week. Notably, shares have registered declines in each of the last two weeks.

Private Equity Players Eyeing Restaurant Operators

The move comes as Billionaire Jack Cowin, the largest shareholder of Domino’s Pizza Enterprises, took charge at the company earlier this year to implement a turnaround.

He wants to shift away from higher prices and reliance on food coupons toward lower prices and fewer tokens to make menu prices more transparent, according to the report.

The development follows a surge in private equity players eyeing deals in the restaurant space. Earlier this month, Reuters reported that Apollo Global Management has submitted a bid to acquire U.S. fast-food chain Papa John’s. Deals in recent years have included the buyouts of brands such as Subway, Dave’s Hot Chicken, and Jersey Mike’s.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<