According to data from Fiscal AI, Wall Street expects Lucid to report second-quarter revenue of $287.20 million and a loss per share of $0.22; analysts expect Rivian to report revenue of $1.29 billion in the quarter and a loss of $0.64 per share.

Retail investors following EV maker Lucid Group (LCID) and Rivian Automotive (RIVN) are now keenly eyeing the second-quarter earnings of both companies, slated for after-market close on Tuesday.

According to data from Fiscal AI, Wall Street expects Lucid to report second-quarter (Q2) revenue of $287.20 million and a loss per share of $0.22, compared to a loss of $0.31 per share reported in the corresponding quarter of 2024. Analysts expect Rivian to report revenue of $1.29 billion in the quarter and a loss of $0.64 per share.

In the second quarter through the end of June, Lucid delivered 3,309 vehicles, in contrast to Rivian’s 10,661 vehicles. While Lucid has previously said that it expects to manufacture about 20,000 vehicles in 2025, Rivian is looking to deliver 40,000 to 46,000 vehicles in 2025. Both companies, however, have yet to report positive earnings per share in any quarter.

On Stocktwits, retail sentiment around Rivian improved from ‘extremely bearish’ to ‘bearish’ territory over the past 24 hours, while message volume stayed at ‘low’ levels.

A Stocktwits user expressed optimism about Rivian beating earnings expectations.

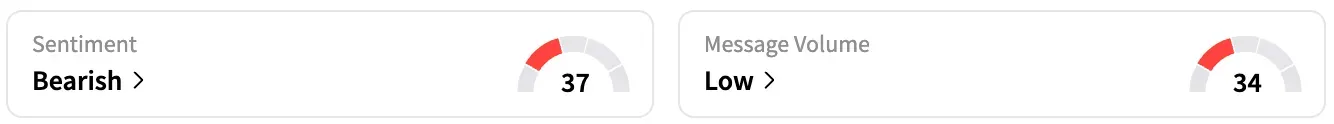

Meanwhile, retail sentiment around Lucid is trending in the ‘bearish’ territory, coupled with ‘low’ message volume.

A Stocktwits user sounded skeptical about the upcoming earnings.

Rivian and Lucid have two passenger vehicles each in their lineups. While Lucid makes the Air sedan and the Gravity SUV, Rivian currently manufactures the R1T truck and the R1S SUV.

These vehicles are priced at the higher end, above $70,000. While the only currently available variant of the Gravity SUV has a starting sticker price of $94,900, the cheapest variant of the Air sedan starts at $70,900. Rivian R1T, likewise, starts at $70,990, while the R1S starts at $76,900.

Both companies have spelled out plans to manufacture cheaper models in the future. Rivian is looking to start production of its midsize SUV called R2 in the first half of 2026. The vehicle is expected to be priced around $45,000, expanding Rivian’s total addressable market. Lucid, however, has yet to provide more details on its future cheaper offering.

While RIVN stock is down by 6% this year, LCID is down by about 21%.

Read also: BioCryst Eyes Strengthening Pipeline After Upbeat Q2 Earnings: Retail Thinks Fair Valuation For Stock Is Double The Current Level

For updates and corrections, email newsroom[at]stocktwits[dot]com<