- TD Cowen raised its price target on Elevance Health to $380 from $330 while maintaining a ‘Buy’ rating after the insurer’s Q3 earnings.

- The firm cited stronger Medicare Advantage expectations offsetting a softer Medicaid outlook that could weigh on 2026 results.

- Elevance reaffirmed its 2025 adjusted profit forecast of about $30 per share and expects Medicaid cost pressures to ease gradually through 2027.

TD Cowen raised its price target on Elevance Health to $380 from $330, implying an upside of about nearly 10% while maintaining a ‘Buy’ rating after the company reported its third-quarter (Q3) results earlier this week.

The firm noted that the company maintained its FY25 guidance but that FY26 was implied lower versus consensus on a more negative Medicaid (MDCD) outlook, offset by more upbeat Medicare Advantage (MA) expectations.

Earnings Review

Earlier this week, Elevance reported Q3 operating revenue of $50.1 billion, up 12% from a year earlier, and adjusted diluted earnings per share (EPS) of $6.03.

The company reaffirmed its FY25 adjusted profit forecast of about $30 per share and a medical loss ratio of 90%, while returning $3.3 billion to shareholders through buybacks and dividends.

CEO Gail Boudreaux said the results reflected “disciplined execution” and emphasized the company’s focus on affordability, member experience, and long-term growth.

Medicaid And Cost Outlook

Elevance said on Tuesday it expects elevated medical costs in its Medicaid business to persist into next year and possibly subside only in 2027.

CFO Mark Kaye told analysts the company views 2026 as the low point for Medicaid profitability, with improvement expected through 2027.

The insurer attributed higher costs to increased demand for behavioral health services and weight-loss drugs across its government-backed plans. It also anticipates higher fourth-quarter utilization as members use benefits ahead of changes to Affordable Care Act plans next year.

The expiration of additional premium tax credits in 2026, originally introduced during the pandemic, has added uncertainty to individual plan enrollments. Elevance said it will issue its formal 2026 forecast in January, once there is more clarity on policy renewals.

Stocktwits Users Back Elevance Health

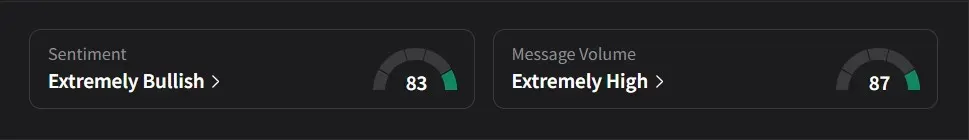

On Stocktwits, retail sentiment for Elevance Health was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said they believed Elevance Health remained a well-managed insurer that would continue to perform strongly even if the broader market corrected.

Another user said it was “time to buy” the stock, expressing a bullish view on Elevance.

Elevance Health’s stock has declined 5% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<