Newmont Corp.’s (NEM) shares fell over 5.4% in extended trading on Thursday after the gold miner cautioned about a hit to its fourth-quarter free cash flow due to higher costs.

The free cash flow outlook also took the shine away from a third-quarter profit beat, aided by higher gold prices and its cost-saving initiatives.

Newmont’s Q4 Cash Flow To Take A Hit From Higher Yanacocha Spending

“Compared to the previous quarter, fourth-quarter free cash flow is expected to be adversely impacted by the continued increase in spending on construction of the Yanacocha water treatment facilities,” the company said in a statement. It is also expected to incur costs related to layoffs during the third quarter.

The company posted adjusted third-quarter earnings of $1.71 per share, topping Wall Street’s estimate of $1.45 per share. Its quarterly sales of $5.52 billion also beat estimates of $5.30 billion, according to Fiscal.ai data.

Newmont’s average realized gold prices jumped to $3,539 per ounce from $2,518 per ounce a year earlier, aided by the recent rally in bullion prices. Higher gold prices helped the company offset a 15% drop in production to 1.42 million ounces, due to lower ore grades, maintenance at its Penasquito and Lihir projects, and the completion of mining at the Subika project in Ghana.

The company added that its 2025 all-in sustaining cost per ounce projections remain unchanged, as improvements from favorable macroeconomic conditions and its cost-savings initiatives are largely offset by higher royalties, production taxes, and costs associated with profit-sharing agreements in a stronger gold price environment.

What Is Retail Thinking?

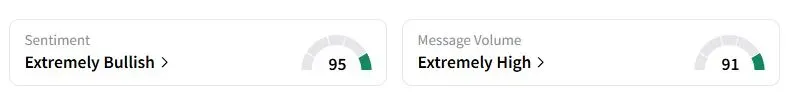

Retail sentiment on Stocktwits about Newmont was in the ‘extremely bullish’ territory at the time of writing.

Most retail investors said the drop was likely temporary following strong third-quarter profit figures. “If you believe in gold, this is the best play out there right now IMO,” one user wrote.

What Is Newmont Forecasting For 2026?

Newmont projected its 2026 production toward the lower end of its 2025 output, due to a lower proportion of gold production expected at its Peñasquito mine, and lower leach production from Yanacocha as mining activities are concluded at the Quecher main pit.

It also expects capital spending to rise next year, as key projects advance, including the tailings work at Cadia and the potential expansion project at Red Chris. However, the company added that the uptick will be in line with prior expectations.

Newmont stock has more than doubled this year, far outperforming the impressive 57% rise in bullion prices.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<