- Indian markets extended their winning streak with the Nifty crossing 26,000.

- Optimism over a potential US-India trade deal drove buying momentum.

- Analysts see Nifty in a strong third wave, cautioning traders against shorting.

Indian equity markets continued the bullish momentum, with the Nifty index opening above 26,000 for the first time since September 2024. Renewed optimism over a US-India trade deal has sustained the buying interest. The technology sector led the gains, rising nearly 2%. On the other hand, pharma, real estate, consumer durables, and energy stocks were under some pressure.

At 09:30 a.m. IST, the Nifty 50 was up 199 points at 26,067, while the Sensex was up 707 points at 85,133. Broader markets were mixed, with the Nifty Midcap index gaining 0.1%, and the Smallcap index declining 0.25%.

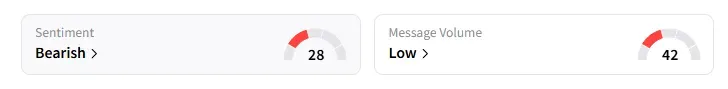

The retail sentiment on Stocktwits for the Nifty was ‘bearish’ at market open amid ‘high’ message volumes.

Stock Watch

Infosys was the top Nifty gainer, surging over 3%. Its promoters, including Nandan Nilekani and Sudha Murty, have decided not to participate in the company’s ₹18,000 crore share buyback.

Gokaldas Exports rose 9%, Vardhman Textiles surged 8%, while Pearl Global, KPR Mill, Trident, and Welspun Living gained 5% on reports of a trade deal being signed soon between the US and India.

Bharat Electronics gained 1% on securing a ₹633 crore order.

NMDC shares fell over 2% after the company revised iron ore prices effective October 22.

Investors will be monitoring Hindustan Unilever, Colgate Palmolive (India), Laurus Labs, PTC India Financial Services, Tata Teleservices (Maharashtra), Fabtech Technologies, Jumbo Bag, Andhra Cements, Sagar Cements, South India Paper Mills, and Vardhman Textiles as they report Q2 earnings today.

Stock Calls

Analyst Vinayak Gautam shared three stock recommendations for Thursday with a 1-week timeframe:

Apollo Tyres: Buy at ₹515, with a target price of ₹555, and a stop loss at ₹493

Laurus Labs: Buy at ₹923, with a target price of ₹975, and a stop loss at ₹900

NMDC: Buy at ₹75.61, with target price of ₹78, and stop loss at ₹74

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Ashish Kyal said that according to Elliott Wave analysis, the market appears to be in its third wave, suggesting strong upward potential.

Kyal advised traders against shorting this market. Existing long positions should trail stops to 25,790, while new long entries can be considered near 25,960 or on any dips, targeting an upside move toward the 26,060–26,200 range.

A&Y Market Research identified Nifty (Intraday) resistance at 25,891 – 25,905, with support at 25,742 – 25,757. For Bank Nifty, they see resistance at 58,230 – 58,290 and support at 57,827 – 57,887.

Global Cues

Globally, Asian markets traded lower, while crude oil prices rose after fresh US sanctions on two of Russia’s biggest oil companies.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<