- Activist investor Jana and Super Bowl champion Travis Kelce, along with a couple of executives, have picked up a 9% stake in Six Flags.

- Jana Managing Partner, Scott Ostfeld, said the activist investor looked forward to working with the Six Flags board and management to unlock shareholder value.

- Six Flags stock is down nearly 47% this year, even after accounting for Tuesday’s surge.

Six Flags Entertainment Corp. (FUN) shares rose about 5% in Wednesday’s early premarket session following their 17.73% rally on Tuesday. Much of Tuesday’s jump came in the final hour of trading after Jana Partners teamed up with Super Bowl star Travis Kelce to launch an activist campaign at the theme-park operator.

Six Flags stock is down nearly 47% this year, even after accounting for Tuesday’s surge, as an uncertain macro and geopolitical backdrop weighs down on the consumer discretionary name.

Jana’s Activist Campaign

According to a statement released by Jana, the activist investor, along with Kelce, consumer executive Glenn Murphy, and technology executive Dave Habiger, have collectively accumulated a 9% stake in Six Flags. “JANA plans to engage with the Company’s Board of Directors and management regarding opportunities to enhance shareholder value and improve the guest experience,” it said.

Jana Managing Partner Scott Ostfeld disclosed the investment at the 13D Monitor Active-Passive Investor Summit. “We look forward to working with the Six Flags board and management to unlock shareholder value for the benefit of all stakeholders,” he said in a statement.

“I am a lifelong Six Flags fan and grew up going to these parks with my family and friends,” Kelce said. “The chance to help make Six Flags special for the next generation is one I couldn’t pass up.”

What Retail’s Saying About Jana’s Stake Build

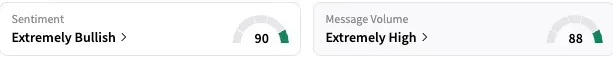

On Stocktwits, retail sentiment toward Six Flags stock improved to ‘extremely bullish’ by early Wednesday from ‘neutral’ a day before, and retail chatter also perked up to ‘extremely high’ levels. The seven-day message volume change on the stream was 2000% over the seven days leading up to late Tuesday.

A bullish watcher said they added Six Flags stock in the after-hours session.

Another user welcomed the move. “Exactly what this company needed. An actual shakeup. Jumped in at $25. Happy to avg down to $20 if necessary, tho I think we’re looking up from here,” they said.

Earlier this month, Texas Capital initiated coverage of Six Flags stock with a ‘Buy’ rating and $28 price target, the Fly reported. The firm views the company as better positioned to offer a strengthened entertainment experience and a more attractive value proposition following the merger with Cedar Fun. A return to pre-pandemic attendance can meaningfully boost Six Flags’ sales and profitability in the coming years, it added.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<