- Krispy Kreme shares rally in Tuesday’s session.

- Morgan Stanley calls out DNUT as the top-performing restaurant stock in Q3.

- Retail sentiment shifts to ‘extremely bullish’ from ‘bearish.’

Krispy Kreme, Inc.’s stock spiked on Tuesday after largely range-bound movement in the past two months, thanks to some backing from Morgan Stanley analysts.

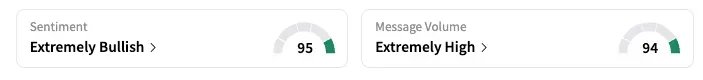

Shares of the donut chain surged nearly 14%, their best performance since Sept. 18. The momentum continued in the after-market session, with DNUT gaining 9.4%. On Stocktwits, the retail sentiment shifted to ‘extremely bullish’ (95/100) from ‘bearish’ the previous day.

In a preview of restaurant sector earnings, Morgan Stanley singled out Krispy Kreme as the top-performing stock in the category in the third quarter, even as it said that overall category trends softened.

Within quick-service names, Krispy Kreme rose 33% and Jack in the Box gained 13%, while most other stocks declined.

The investment research firm maintained its ‘Underweight’ rating and $2.5 price target on DNUT, implying a 33% downside from the stock’s last close.

“Restaurants as a whole have performed poorly as industry data show a slowdown beginning in September,” according to the investor note, reported by MT Newswires.

Looking ahead, Morgan Stanley expects misses to be common this quarter, with fast casual and quick-service restaurants remaining soft while casual dining and food distributors have held up relatively better.

Kripy Kreme’s stock surged by three-quarters in a couple of days in July, when a renewed “meme stock” buzz pumped shares of a handful of companies as Opendoor Technologies and GoPro. It ultimately lost those gains.

A major blow came when the company announced the suspension of its partnership with McDonald’s in late August. The two companies could settle the terms and costs of the partnership, which involved selling Krispy Kreme donuts at McDonald’s outlets.

Year-to-date, DNUT shares are down 62.6%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<