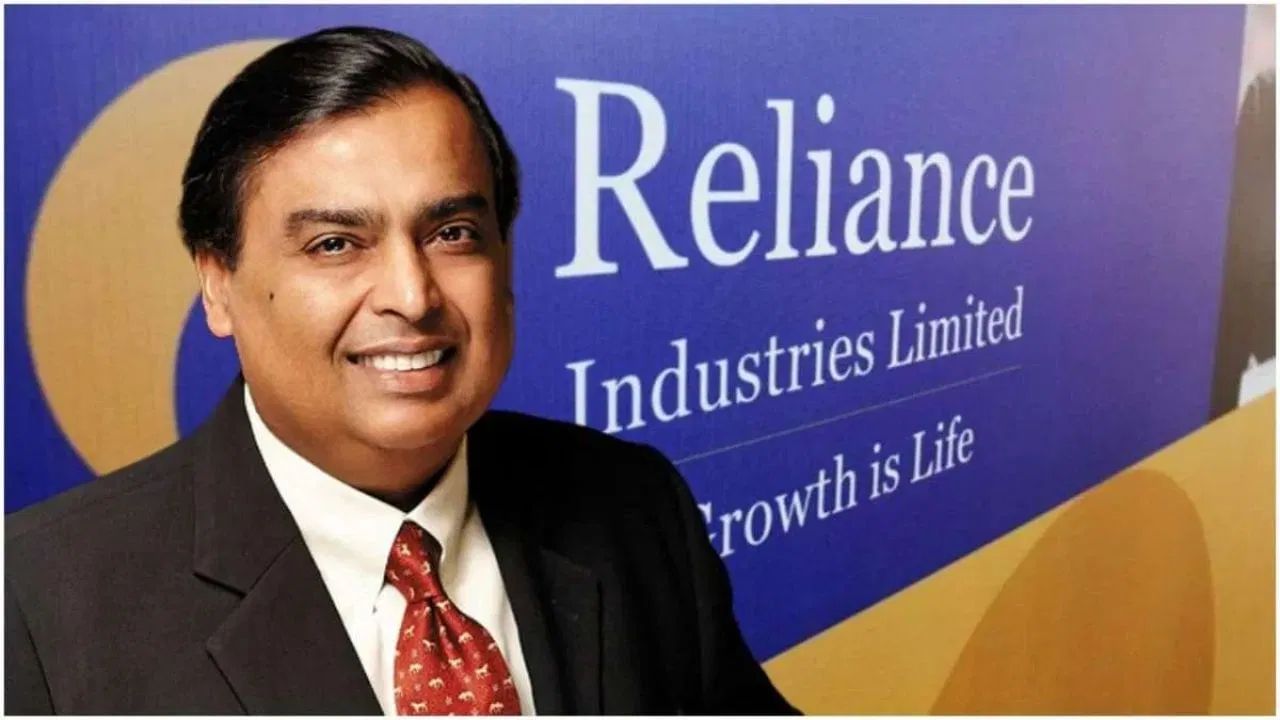

Mukesh Ambani

On the day of Diwali, Mother ‘Lakshmi’ is seen being more kind. In fact, there is a tremendous rise in the shares of Reliance Industries in the stock market on Monday. Due to which the valuation of the company is seeing an increase of about Rs 67 thousand crores in a few minutes. In fact, the main reason for the increase in the company’s shares is the company’s quarterly results. In the quarterly results released on Friday, there has been a tremendous increase in the company’s profit and revenue. Looking at the company’s figures in the stock market, it seems that the valuation may soon cross Rs 20 lakh crore. Let us also tell you what kind of story the company’s figures are telling in the stock market.

Rapid rise in company’s shares

Shares of Reliance Industries Limited (RIL) registered a rise of more than 3 percent on Monday. The company reported a 9.6 per cent year-on-year rise in net profit in the September quarter, driven by the strong performance of its consumer-focused retail and telecom businesses and improvement in the core oil-to-chemicals segment. This giant’s share rose by 3.50 percent to Rs 1466.50 on BSE. Whereas the company’s shares had opened at Rs 1,440 in the morning. On the other hand, the company’s shares are trading at Rs 1,466.70 on the National Stock Exchange with a rise of about 3.50 percent.

Tremendous increase in company’s valuation

Due to the rise in the shares of the company, there has been a tremendous increase in the valuation of the company. When the stock market closed on Friday, the valuation of the company was Rs 19,17,483.71 crore, which came down to Rs 19,84,469.33 crore during the trading session. This means that there has been an increase of about Rs 67 thousand crore in the valuation of the company. If last week’s increase is also included, then there has been an increase of Rs 1.14 lakh crore in the valuation of the company in about 6 days.

Such were the quarterly results

The oil-to-retail company reported a consolidated net profit of Rs 18,165 crore in July-September – the second quarter of the April 2025 to March 2026 financial year (FY26) – up from Rs 16,563 crore in the same period a year earlier, the company said in a statement on Friday. However, profit declined 33 per cent sequentially compared to Rs 26,994 crore in the April-July quarter. New customer additions and growth in revenue per user along with its wireless broadband services becoming the largest in the world helped telecom income register a 13 per cent year-on-year growth, and improvement in store operations metrics led to a 22 per cent growth in retail income. Better refining margins and highest-ever crude oil processing helped the O2C business. The profit of Jio Platforms Limited, a subsidiary of telecom and digital business, increased by 13 percent to Rs 7,379 crore in the second quarter.

Stock market also booming

The stock markets also gained momentum due to the rise in Reliance shares. The 30-share BSE Sensex was trading 438.20 points or 0.52 percent higher at 84,390.39 during the morning trade, while during the trading session the Sensex had risen by more than 700 points to reach 84,656.56 points. On the other hand, the 50-share NSE Nifty was trading at 25,842.35, up 135.40 points or 0.55 percent. Whereas during the trading session, Nifty rose by more than 220 points and reached 25,926.20 points.