- Jio Platforms posted a 14.6% increase in Q2 revenue, while the customer base grew 5.8%.

- A breakout above ₹1,450 could trigger the next leg of its rally, according to analysts.

- They expect a continued uptrend toward ₹1,600 amid sustained institutional buying.

Shares of India’s largest company by market cap, Reliance Industries, gained 3.4% on Monday after its Q2 results turned Dalal Street buoyant.

The oil-to-telecom behemoth reported a strong Q2 FY26 print, with consolidated net profit rising 14.3% year-on-year (YoY) to ₹22,092 crore, up from ₹19,323 crore the previous year, while revenue climbed to ₹2.59 trillion from ₹2.35 trillion.

Jio’s Profit Up 13%

Jio Platforms posted strong growth in Q2, with revenue rising 14.6% to ₹36,332 crore and profit increasing 12.8% to ₹7,379 crore. EBITDA grew 17.7% to ₹18,757 crore, with margins expanding 140 basis points to 51.6%.

The customer base rose 5.8% to 50.64 crore, while the average revenue per user (ARPU) improved to ₹211.4, despite a temporary impact from 5G promotional offers.

Reliance Retail Adds 412 Stores In Q2

Reliance Retail continued its aggressive expansion drive in Q2, adding 412 new stores and taking its total count to 19,821. Revenue for the retail segment rose 19% to ₹79,128 crore, while profit after tax surged 21.9% to ₹3,457 crore. EBITDA grew 16.5% to ₹6,816 crore, though margins slipped slightly by 20 basis points to 8.6% due to higher operating costs and expansion-related investments.

Oil, Gas & Chemicals Business Yield Mixed Results

Reliance’s Oil-to-Chemicals (O2C) segment delivered steady performance in Q2, with revenue rising 3.2% to ₹1,60,558 crore and EBITDA surging 20.9% to ₹15,008 crore. Margins expanded by 130 basis points to 9.3%, supported by improved fuel margins and stronger middle distillate cracks.

Chairman Mukesh Ambani noted that while the O2C business benefited from fuel recovery, downstream chemicals remain under pressure due to global overcapacity.

In contrast, the Oil & Gas Exploration and Production segment saw a 2.6% decline in revenue and a 5.4% drop in EBITDA to ₹5,002 crore. Margins narrowed by 240 basis points to 82.6%, impacted by lower production from the KGD6 block and higher operating costs from maintenance activities.

Capital expenditure for the quarter stood at ₹40,010 crore, driven by capacity expansion in O2C, telecom/digital infrastructure, retail network rollout, and new-energy giga-factory development.

Technical Charts Indicate Bullish Momentum

Reliance’s stock remains firmly in a bullish structure. The stock continues to sustain an uptrend across daily, weekly, and monthly charts, comfortably positioned above its 50-day, 100-day, and 200-day exponential moving averages (EMAs). The long-term 200-day EMA around ₹1,280 offers solid support, while shorter-term averages remain positively aligned, confirming strong momentum, noted SEBI-registered analyst SFP Research.

After forming a base near ₹1,150 in March 2025, Reliance rallied to a record high above ₹1,540 in July before consolidating between ₹1,360 and ₹1,440.

This rectangular pattern indicates steady institutional accumulation. A breakout above ₹1,450 on strong volumes could trigger a fresh uptrend, with price targets projected at ₹1,520 – ₹1,540 initially and ₹1,580 – ₹1,600 on extension. On the downside, supports lie at ₹1,360 – ₹1,380 and ₹1,280 -₹1,300, protecting the broader bullish bias, they added.

Technically, the risk-reward remains attractive for long positions. The analyst recommended buying the stock on dips.

Reliance Industries has broken out of a falling wedge on strong volumes, signaling clear institutional buying interest. It continues to hold above its ascending trendline and 30-week SMA, while a close above ₹1,434.50 could open the path toward ₹1,450 and beyond, said SEBI-registered analyst Rajneesh Sharma.

Momentum indicators support the move, with the daily relative strength index (RSI) at 63.05 showing strength without being overbought, and the moving average convergence divergence (MACD) has triggered a bullish crossover with a rising histogram.

Weekly RSI at 53.98 indicates further room for upside. Key supports lie at ₹1,391.30 and ₹1,343.45, maintaining the bullish structure, Sharma added.

Retail Turns ‘Extremely Bullish’

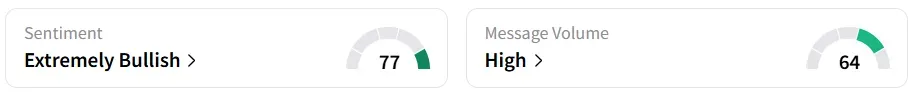

Retail sentiment on Stocktwits turned ‘extremely bullish’ following the results, amid ‘high’ message volumes. It was ‘bullish’ in the previous session. Reliance was also the second-highest trending stock on the platform.

The stock has hit its highest since July and is on track for a third successive session of gains. It was the top gainer on the Nifty50 index.

Year-to-date, the conglomerate has gained more than 20%.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <