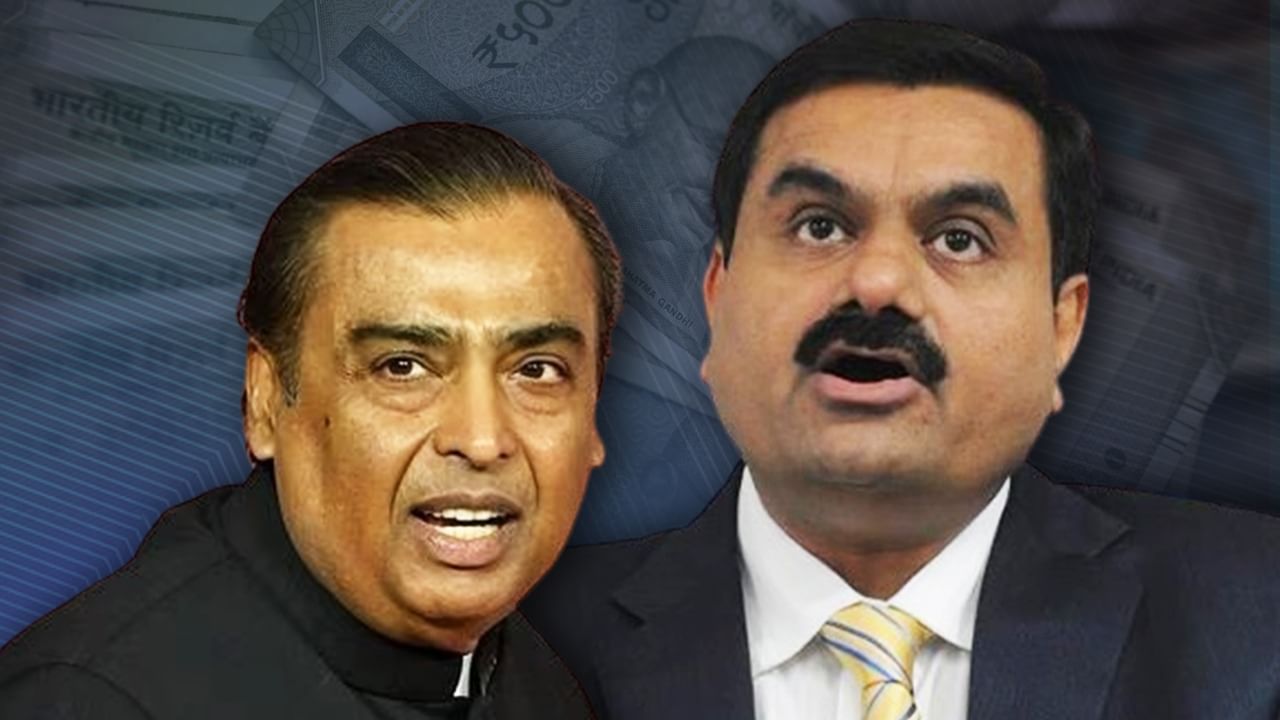

The first half of 2025 saw a significant increase in the wealth of many Indian billionaires despite the clear instability in the market, with foreign and retail investors on a large scale. On the other hand, Mutual Fund retained the high cash level between Jio Political Tension and High Value Equity Markets. By the way, one of these billionaires also left behind Mukesh Ambani and Gautam Adani during this period.

The special thing is that in the case of increase in net worth, this billionaire has overtaken the legendary billionaires of India. In the first half of the current year, this billionaire’s net worth has increased by 78 percent. While Mukesh Ambani and Gautam Adani are far behind in this matter. In fact, it makes billionaire ammunition, detonator, explosive. Let us also tell you who is this billionaire and what is the name of its company?

This billionaire was number one

The wealth of Solar Industries India co-founder and president Satyanarayana Nuwal has seen a tremendous increase in the first half of the current year. According to the Bloomberg Billionaire index data, his total assets increased by more than 78 percent to $ 7.90 billion. The solar industry with headquarters in Nagpur makes explosive, detonator, drone and ammunition. After an increase of 45 per cent in 2024 and 54 per cent in 2023, in 2025, the company’s stock has seen an increase of 81 per cent.

Solar industries have a strong order book of about Rs 17,000 crore – which includes Rs 15,000 crore in the defense order – has increased the confidence of investors significantly. Solar industries are estimated to have a revenue of Rs 100 billion in FY 2026, which is 33 per cent higher than the financial year 2025, with the defense sector expected by Rs 30 billion. According to the company, the explosive segment is estimated to have 15 to 20 percent growth.

Increase in the wealth of Sunil Mittal and Lakshmi Mittal

Bharti Airtel Chairman Sunil Mittal and Laxmi Mittal, chairman of Arcelor Mittal, the world’s largest steel maker, were the second and third largest gainer. Sunil Mittal’s assets increased by 27 percent to 30.40 billion dollars, which gained 54 percent in 2024 and 28 percent in 2023, Bharti Airtel’s shares gained 27 percent in 2025.

Analysts believe that strong customer engagement is expected to increase revenue in future after recent tariffs. Laxmi Mittal’s total assets increased by more than 26 percent, the stock of Arcelor Mittal, listed in Luxembourg, increased by more than 20 percent, despite concerns about increasing tariffs in Europe, which is expected to affect the margin.

The wealth of these billionaires has increased

Other notable gainers include Rahul Bhatia, co-founder of Interglobe Aviation (IndiGo-India’s largest airline), whose assets increased by about 25 percent to $ 10.8 billion. Reliance Industries Chairman Mukesh Ambani’s wealth increased by 22 percent. Radhakishan Damani, who controlled Avenue Supermarts, registered a 21 percent increase. Shri Cement Honorary Chairman Benu Bangur and former MD Director of Kotak Mahindra Bank Uday Kotak registered an increase of more than 20 percent.

According to Bloomberg data, Vikram Lal (16 percent increase in assets) of Eicher Motors among other billionaires, Nusli Wadia (16 percent increase in property), British Industries President Nusli Wadia (16 percent increase), Interglobe Aviation co-founder Rakesh Gangwal (14.5 percent), Aditya Birla Group President Kumar Mangalam Bidla (11.4 percent), Diviz Laboratories Founder (11.4 percent) Murali Divi (10 percent) and Adani Group founder Gautam Adani (9 percent).

On the other hand, the wealth of RJ Corp President Ravi Jaipuria saw the most decline – 24.6 percent decline – after this, the stock of its leading subsidiary Varun Beverages, which is a franchise of PepsiCo, declined by 28.5 percent. Azim Premji (Wipro) and Shapoor Mistry (Tata Sons) lost about 8 percent, while the property of Shiva Nadar declined by more than 6 percent.

7 percent stock market raised

During this period, the benchmark index Sensex and Nifty rose by 7.2 per cent and 8.1 per cent respectively. However, the BSE Midcap index rose by just 0.5 per cent and the BSE Smallcap index saw a decline of 1.2 per cent. Foreign institutional investors (FIIs) sold Indian equity worth more than $ 8.92 billion, while retail investors added just Rs 5,000 crore. Mutual funds remained a pure buyer, who invested more than Rs 2.38 lakh crore in equity, cash holding was Rs 1.65 lakh crore in May, which was Rs 1.73 lakh crore in April.