Shares of KEI Industries slumped 8.8% to ₹4,031.9 on Thursday, despite reporting a strong second-quarter print.

Over the last 13 sessions, KEI’s shares have declined just thrice, including today. During this period, the stock added over 9%.

Profit Surges Over 30%

KEI Industries reported a 31.3% year-on-year (YoY) increase in net profit to ₹204 crore for the September quarter, compared to ₹155 crore last year. Revenue from operations climbed 19.4% YoY to ₹2,726 crore, driven primarily by the Cables & Wires segment, which grew 23% due to healthy domestic demand and rising copper prices.

In contrast, the revenue from stainless steel wires declined 10% from the previous year. EBITDA rose 20% to ₹269.1 crore, below street estimates of ₹283 crore, with margins coming in at 9.9%, nearly flat year-on-year but slightly lower than the anticipated 10.2%.

The company’s order book stood at ₹3,824 crore as of September 30, reflecting a strong pipeline.

Mixed Reaction By Brokerages

Morgan Stanley retains an “overweight” rating with a ₹4,825 price target, citing 12–15% volume growth in cables and wires, while Investec maintains a “hold” rating, citing potential pressure from upcoming capacity additions and increased competition. Nuvama reiterated a ‘Buy’ rating with a target price of ₹4,450.

Technical Analysis Shows Stock On Uptrend

Technical analysis shows KEI in a firm uptrend following last year’s correction, noted SEBI-registered Front Wave Research.

With strong margins, healthy cash flows, and ongoing capacity expansion, the stock is poised to continue its upward trajectory, with potential to test all-time highs near ₹5,000.

Execution remains the key theme, with margin stability, strong cash flows, and capacity build-out positioning KEI for a strong finish in fiscal 2026, they added.

Retail Sentiment Turns Bullish

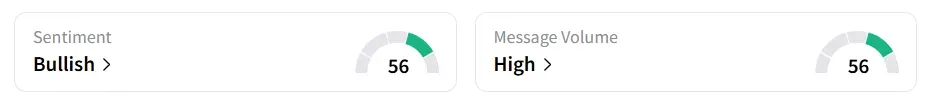

Despite the steep intra-day decline, retail sentiment for KEI on Stocktwits turned ‘bullish’ on Thursday, amid ‘high’ market chatter. It was ‘neutral’ a day earlier.

On a year-to-date basis, the stock has shed 5.4%.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <