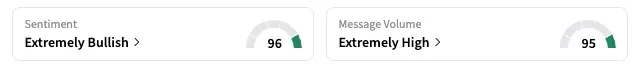

The message volume for IRBT rose over 3,600% and sentiment shifted to ‘extremely bullish’ from ‘neutral,’ according to Stocktwits data.

iRobot Corp’s shares soared nearly 37% to a seven-month high on Wednesday, and extended gains in the after-market session, without a substantial catalyst, piquing retail traders’ interest.

On Stocktwits, the 24-hour message volume on the ticker rose a whopping 3,633% as retail sentiment shifted to ‘extremely bullish’ (96/100) from ‘neutral.’

Before Wednesday, the automatic vacuum cleaner maker’s shares had largely been confined to a narrow trading range. The sudden surge sparked chatter among retail investors about a potential short squeeze — a sharp rally in a heavily shorted stock that forces bearish investors to buy shares to limit losses, further fueling the price jump.

“$IRBT shorts covering on such large squeeze means they know something big is coming, maybe a buyout or merger or new product,” guessed a user, while another said they will keep the stock on watch if it holds above $5 on Friday.

Notably, Amazon pursued the acquisition of iRobot for two years but dropped it in 2024 after failing to convince regulators, particularly in Europe, that the deal was not anticompetitive. iRobot’s stock and fundamentals have since declined considerably.

Meanwhile, the company’s marketing chief, Athena Kasvikis, went on a podcast to discuss optimism about the company’s products and marketing initiatives. An Ad Age report from Wednesday quoted her as talking about AI cameras on iRobot’s Roombas, the marketing push around AI, and the company’s new TV campaign.

iRobot is in a “really interesting growth phase right now, both from a product perspective but also from a marketing perspective,” Kasvikis said.

Year-to-date, iRobot shares are down 30.7%. The short interest in the stock is 26.1%, according to Koyfin data. That’s on the higher side, but it is lower than the 27.5% peak in June.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<