The company said it saved $20 million in the third quarter under its previously announced cost-saving plan.

J.B. Hunt Transport Services (JBHT) stock jumped over 12% in extended trading on Wednesday after the company’s third-quarter revenue topped Wall Street estimates.

The logistics firm reported revenue of $3.05 billion for the quarter ended Sept. 30, exceeding analysts’ expectations of $3.01 billion, according to Fiscal.ai data. Its net earnings rose to $1.76 per share, compared with $1.49 per share for the same period last year.

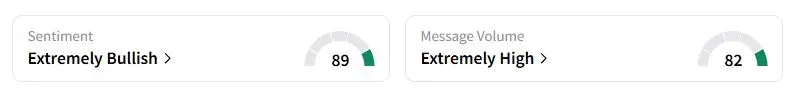

Retail sentiment on Stocktwits about JB Hunt was in the ‘extremely bullish’ territory at the time of writing.

J.B. Hunt said that segment revenue from its intermodal segment fell 2%, while volume decreased 1% over the same period in 2024. Transcontinental network loads decreased 6%, while Eastern network loads increased 6% compared to the third quarter of 2024, as it reshuffled its truck network to focus on reducing empty moves.

“Overall demand trended below normal seasonality for much of the quarter outside of the seasonal lift we saw at quarter end,” said the vice president of sales and marketing, Spencer Frazier. “On the supply side, truckload capacity continued to exit the market, and the pace of exits is accelerating, but the soft demand environment is likely muting the market impact of capacity attrition.”

U.S. consumer confidence has come under pressure this year due to higher tariffs imposed by the Trump administration, while the job market is also under pressure, prompting the Federal Reserve to lower interest rates for the first time this year.

The company said its focus on cost savings helped it limit expenses by $20 million in the third quarter, as part of its $100 million cost reduction plan. It also expects to see solid activity in the fourth quarter as businesses ship products before the holiday season.

The company also tried to address concerns about its intermodal segment, the largest in terms of revenue, amid chatter about further consolidation in railroads. This follows Union Pacific’s $85 billion deal for Norfolk Southern, aimed at challenging the dominance of trucks.

“We have offered seamless Transcontinental Intermodal services for decades, connecting BNSF with both Eastern railroads, and believe that opportunity could exist well into the future, regardless of the various outcomes we know are either announced or speculated in the market,” Darren Field, the president of the intermodal segment, said.

J.B. Hunt stock has fallen about 19.3% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<