Broader markets outperformed, with midcaps and smallcaps gaining up to 1%. Strong earnings from Persistent and ICICI Lombard further fueled sentiment.

Indian equity markets snapped two-day losses, with the Nifty index reclaiming 25,300. Optimism over US Fed rate cuts, as well as policy easing by India’s central bank in the December policy, supported the market sentiment. Real estate, PSU banks, metals, and financials led the recovery. Media was the only sector to end in the red.

On Wednesday, the Sensex closed 575 points higher at 82,605, while the Nifty 50 ended up 178 points at 25,323. Broader markets outperformed, with the Nifty Midcap index rising 1.1% and the Smallcap index gaining 0.8%.

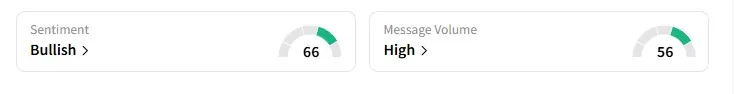

The retail investor sentiment surrounding the Nifty 50 remained ‘bullish’ by market close on Stocktwits.

Stock Moves

Persistent surged 7% after the company delivered a powerful quarter, marking its 22nd straight quarter of sequential revenue growth, supported by strong BFSI traction.

Front Wave Research remains constructive, with margin discipline and BFSI-led deal momentum serving as key supports. They advised traders to watch for a breakout above ₹5,500 as a signal for renewed accumulation.

Other earnings movers include ICICI Lombard, which rose 10%, Bank of Maharashtra (+7%), and Tech Mahindra, which slipped 1%. Infosys too saw some weakness ahead of its Q2 earnings.

HDFC AMC surged 3% on strong earnings performance and the announcement of a 1:1 bonus issue.

Mishra Dhatu Nigam shares ended 2% higher on an order win worth ₹306 crore. Ashok Kumar Aggarwal of Equity Charcha said that the stock was consolidating and trading in a tight range. He shared a short-term trade call, advising traders to buy between ₹380 and ₹384, with a stop loss at ₹370 and a target price of ₹404.

Waaree Energies too rose over 1% on a fresh order win.

Markets: What Next?

Globally, European markets traded mixed, while US stock futures indicate a positive start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <