CEO Christophe Fouquet warned of a significant decline in China revenue in 2026 but said the year’s sales will not decline year-over-year.

Shares of Dutch semiconductor-equipment maker ASML Holding N.V. (ASML) rose over 3.5% in the early premarket session on Wednesday following the company’s quarterly results.

Veldhoven, Netherlands-based ASML said third-quarter revenue climbed 0.7% year-over-year (YoY) to 7.526 billion euros ($8.8 billion) even as it declined 2.3% from the prior quarter. The company sold 66 new lithography systems, a decrease from the 67 units sold in the second quarter.

Lithography systems aid in creating intricate circuitry for microchips by using light to transfer patterns onto a silicon wafer. ASML supplies these systems to foundries such as Taiwan’s TSMC, which in turn makes chips for the world’s biggest tech companies, such as Apple, Nvidia, and Intel.

Net bookings, which refer to customer orders, minus any cancellations and other adjustments, were at 5.4 billion euros, down from 5.54 billion euros in the previous quarter, but up sharply from the year-ago’s 2.63 billion euros.

Extreme ultraviolet (EUV) lithography systems used in the production of the most advanced microchips utilized in high-performance computing, such as artificial intelligence (AI), accounted for 3.6 billion euros of the total net bookings.

CEO Christophe Fouquet said, “Our third-quarter total net sales of €7.5 billion and gross margin of 51.6% were in line with our guidance, reflecting a good quarter for ASML.” He, however, warned that ASML’s total net sales in China in 2026 would decline significantly compared to outstanding business there in 2024 and 2025.

ASML guided fourth-quarter net sales of 9.2 billion euros to 9.8 billion euros, with a gross margin of 51%-53%. The company expects full-year net sales growth of 15%, in line with the guidance issued in July, and raised its gross margin outlook to 53% from about 52%. It also does not expect 2026 sales to be lower than in 2025, while in mid-July, the company said it couldn’t confirm whether it would grow in the next fiscal year.

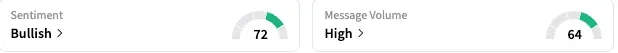

On Stocktwits, ASML stock was among the top 10 trending equity tickers as of early Wednesday. Retail sentiment toward the stock improved to ‘bullish’ (72/100) from ‘bearish’ the day before, and the message volume increased to ‘high’ levels.

The company said an interim dividend of 1.60 euros per ordinary share would be payable on Nov. 6.

ASML stock has gained 43% year-to-date.

Note: 1 euro = $1.16

For updates and corrections, email newsroom[at]stocktwits[dot]com.<