The analyst believes a breakout could spark a rally toward ₹1,250–₹1,500 if volume confirms the move.

After a prolonged corrective phase since its 2021 highs, Tanla Platforms appears to be approaching a critical inflection point. A cloud communications provider, Tanla Platforms, has seen an over 40% rally in its stock price in the past six months.

According to SEBI-registered analyst Rajneesh Sharma, the formation of a multi-year wedge base, along with improved technical charts and momentum indicators, suggests that the stock could be gearing up for a significant move, but confirmation is key.

What do the technical charts indicate?

Shara highlighted that a Falling Wedge formation is visible on its charts. This is typically considered a bullish reversal pattern. It has retested the support zone of ₹360–400 multiple times since 2022, forming a solid base.

Tanla Platforms’ stock is now coiling near the apex of this wedge (₹750–₹770), hinting at potential breakout pressure.

It is also displaying a clear bullish divergence with its RSI (Relative Strength Index), which is making higher lows while the stock price is making lower lows.

RSI has now crossed above 56–58, indicating building positive momentum.

Tanla Platforms: key levels to watch

Sharma identified the resistance zone at ₹750–₹800. A breakout above this would confirm a wedge breakout. On the downside, support is seen at ₹609–₹625. He added that Tanla must hold this level for structural strength.

He also flagged a long-term base support at ₹360–₹400, adding that a repeated bounce at this price point acts as a foundation for any upward move.

How to trade Tanla Platforms now?

Sharma shared two scenarios to play this stock ahead. In case of a bullish setup where the breakout sustains, he believes that a break above ₹800 could lead to a sharp rally toward ₹1,150–₹1,250, with potential extension to ₹1,500+. This could mark the start of a new uptrend cycle.

On the other hand, if the resistance holds, resulting in a bearish setup, a failure to break ₹800 may cause a pullback to ₹625 or ₹500. And a breakdown below ₹500 would invalidate the ascending structure. However, given the confluence of bullish signals, this remains a contrarian view.

Sharma concluded that if the ₹800 zone breaks, it could unlock fresh upside and reignite momentum in a stock that’s been under the radar. Until then, this remains a watchlist-worthy setup, with volume confirmation being the key trigger.

What is the retail mood on Stocktwits?

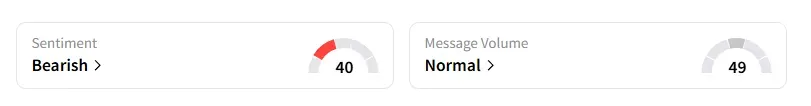

Data on Stocktwits showed that retail sentiment has been ‘bearish’ for a week on this counter.

Tanla Platform shares have risen only 5% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<