According to Fiscal.ai data, Wall Street expects America’s largest bank to post earnings of $4.86 per share for the quarter ended Sept. 30, on revenue of $45.42 billion.

JPMorgan & Chase Co (JPM) stock has dipped marginally over the past week ahead of the lender’s third-quarter earnings on Tuesday.

According to Fiscal.ai data, Wall Street expects America’s largest bank to post earnings of $4.86 per share for the quarter ended Sept. 30, on revenue of $45.42 billion. JPMorgan topped expectations in all four previous quarters.

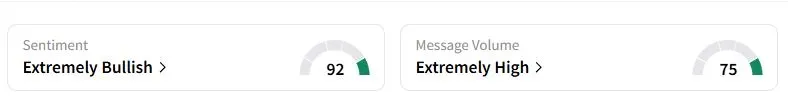

Retail sentiment on Stocktwits about JPMorgan was in the ‘extremely bullish’ territory at the time of writing.

“Within banking, the outlook for loan growth and net interest income (NII) could be supported by the resumption of the rate-cutting cycle,” said Adam Turnquist, Chief Technical Strategist for LPL Financial. The Federal Reserve lowered benchmark interest rates by 25 basis points in September amid signs of weakness in the job market.

“Credit quality metrics will be another focal point this earnings season, as net charge-offs and loan loss provisions could shed some light on the health of the consumer,” Turnquist said. Some analysts have also cautioned that the effects of tariffs on small businesses would likely start to show during the third quarter.

Dealmaking is also a bright spot for JPMorgan, as the Trump administration has adopted a more favorable approach to mergers. The third quarter was also the busiest three-month period this year for new listings, as more firms went public amid soaring stock market and rate hike bets.

According to Dealogic data, U.S. mergers and acquisitions reached $665.6 billion in the third quarter of 2024, far exceeding the $403.1 billion in the same period last year. Investors will also be keen to hear from JPMorgan CEO Jamie Dimon on his view about the economy.

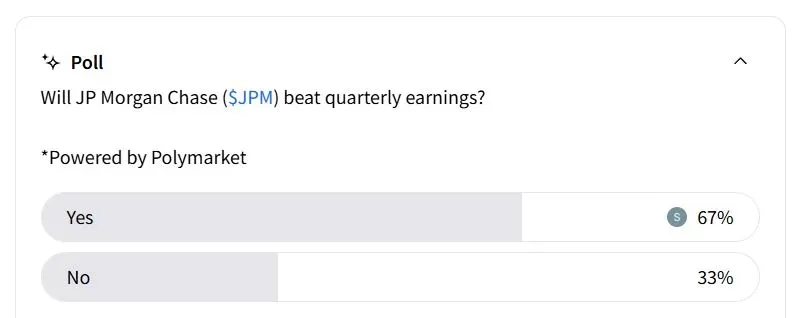

A Stocktwits poll showed that an overwhelming majority of retail traders expect JPMorgan to top earnings estimates on Tuesday.

JPMorgan stock has risen 27.8% this week, compared with 13.8% gains of the Invesco KBW Bank ETF. On Monday, the lender said it plans to invest $1.5 trillion over the next decade in industries deemed vital to U.S. economic and national security.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<