HCL Technologies delivered a stable Q2 with improving margins and growing traction in AI-led deals. Experts flag resistance near ₹1,500–₹1,515 as the key level to watch.

HCL Technologies shares surged over 2% on Tuesday after the company delivered a solid operational quarter, with margin recovery quarter-on-quarter (QoQ), visible traction in AI-led deals, and improved FY26 guidance.

It became the first Indian IT services company to disclose standalone revenue from AI offerings. For Q2, it reported that its advanced AI business generated over $100 million in revenue and that nearly all new deals included an AI element.

HCL Tech MD, C Vijayakumar, said, “For the first time, our new bookings surpassed $2.5 billion, without reliance on any mega-deal. We added 3,489 people to our employee base while continuing to increase our revenue per employee 1.8% YoY, aligned with our AI growth strategy.“

The IT major reported a net profit of ₹4,235 crore for the September quarter (Q2 FY26), marking a flat performance compared to the previous year. The company’s revenue surged 11% year-on-year (YoY) to ₹31,942 crore in Q2. Margins improved to 17.4% from 16.3% (QoQ).

They maintained FY26 revenue growth projection in the range of 3-5% on a YoY basis on a constant currency basis. And raised full fiscal services revenue guidance in the range of 4-5% from 3-5% projected earlier.

Rating Outlook

SEBI-registered analyst Front Wave Research noted that HCL Tech’s 24× P/E ratio is considered fair, given its profitability profile, though sub-5% revenue growth leaves room for re-rating only upon stronger execution. The company’s advantage lies in disciplined operations and sustained revenue growth via AI integration. Analysts suggest monitoring whether this translates into volume growth or margin expansion over the upcoming quarters, as either could justify a higher valuation multiple.

Technical Outlook

On the technical charts, HCL Tech stock’s current structure resembles a (bearish) Head & Shoulders under construction. It hovers between the 200-week moving average near ₹1,352 and ₹1,600, a zone considered unsuitable for fresh trades.

Front Wave said that a bullish bias would emerge only if the pattern invalidates with a decisive close above ₹1,600, potentially triggering a rally. Structural confirmation would come from a close above ₹1,750, which would signal a fresh upmove. On the other hand, a close below ₹,1,352 (200W MA) would raise the risk of completing the bearish setup, and a fall below ₹1,237 would confirm a longer downtrend, prompting caution.

Sudhansu Panda, Founder of Bluemoon Research & Financial Services, added that HCL Tech stock has looked very volatile in the last few months. It faced strong resistance between ₹1,500 and ₹1,515, which needs to be broken for a strong upmove.

According to Panda, if the stock sustains above ₹1,515, a short-term rally towards ₹1,600 to ₹1,630 is likely, with support around ₹1,400.

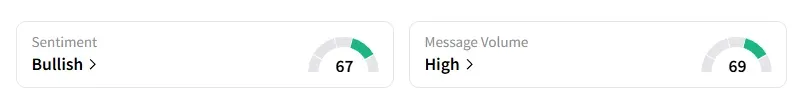

What Is The Retail Mood?

Data on Stocktwits showed that retail sentiment has been ‘bullish’ for a month and inching higher.

HCL Technologies’ shares have declined 21% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<