The next hearing is scheduled for October 27. Analyst said the stock remains speculative and is likely to trade sideways near key moving averages.

Vodafone Idea’s stock declined nearly 4% on Monday, after the Supreme Court once again deferred the hearing on the company’s Adjusted Gross Revenue (AGR) dues.

India’s apex court adjourned the cash-strapped telecom operator’s plea seeking a waiver of interest, penalty, and interest on penalty related to its AGR dues raised by the Department of Telecommunications. The next hearing is scheduled for October 27.

The Union government’s request for more time, made by Solicitor General Tushar Mehta, led to the deferral of the case hearing. Chief Justice of India BR Gavai asked Mehta to present a clear position, marking the fourth time the case’s hearing has been postponed.

VI’s AGR Dues

The company is embroiled in a tussle with the Department of Telecommunications (DoT) over a debt amount. A Supreme Court ruling from March 2020 finalized Vodafone Idea’s AGR dues up to FY17 based on the Department of Telecommunications’ (DoT) calculations and prohibited any reassessment.

However, the DoT has since issued fresh demands for FY18 and FY19, which Vodafone Idea challenged in a petition filed on September 8, arguing that these years were already covered under the 2020 judgment.

The company claimed the revised calculation exceeds the Court’s scope, with about ₹5,675 crore attributed to the pre-merger Vodafone Group and ₹2,774 crore to the merged entity. Vodafone Idea also alleged duplication in DoT’s assessment, stating that nearly ₹5,606 crore had already been settled earlier.

Mounting Debt

The government now owns around 50% of Vodafone Idea, following the conversion of ₹53,083 crore in AGR dues into equity during 2023 and 2025. Despite this, the company remains under severe financial stress, with AGR dues of roughly ₹83,400 crore to be paid in annual instalments of ₹18,000 crore starting March 2026. Including penalties and interest, the total government liabilities are estimated at around ₹2 trillion.

Settlement On The Horizon?

According to a Bloomberg report last week, the Indian government is reportedly considering a one-time settlement of its long-standing ₹2 trillion dispute with Vodafone Idea to boost economic and diplomatic relations with the United Kingdom.

The plan may include waiving interest and penalties, along with a partial reduction in the principal amount.

Technical Overview

The stock is moving sideways and currently taking support near the 21-day simple moving average (SMA), said SEBI-registered analyst Sunil Kotak.

The 21-day SMA has crossed above the 50-day SMA and is sustaining, but the overall trend remains sideways. Since the stock is highly speculative, it’s better to stay away, and traders should maintain a strict stop-loss if taking up new positions, he added.

Stock Watch

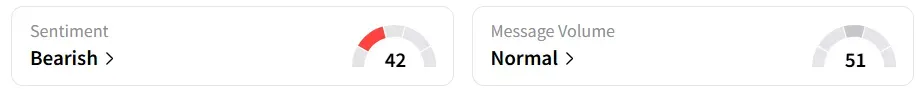

Retail sentiment remained ‘bearish’ on Stocktwits. It was ‘bullish’ a week earlier.

Vodafone Idea was also among the top three trending stocks on the platform.

Year-to-date, the stock has gained over 10%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<