The first set of analysts to begin coverage on the stock is optimistic.

StubHub shares climbed nearly 4% in early premarket trading on Monday, fueled by bullish commentary from Wall Street brokerages.

Goldman Sachs and BMO Capital initiated coverage with a ‘Buy’ rating and price targets of $46 and $30, respectively, according to their investor note summaries posted on The Fly early Monday.

The online ticketing company raised $800 million in an initial public offering last month. Its shares debuted on the New York Stock Exchange on Sept. 17, and have declined 20% since then.

StubHub offers a marketplace for people to buy and sell tickets for live events, including concerts, sports games, theater, and festivals. It was founded in 2000 and was briefly owned by eBay before founder Eric Baker bought it back.

Both Goldman Sachs and BMO Capital stated that the company is a leader in the global secondary ticketing market and will continue to take share as events boom.

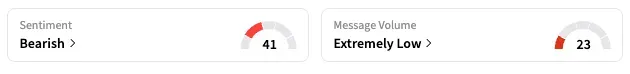

According to Koyfin, no analysts were covering the stock as of Sunday. On Stocktwits, the retail sentiment for STUB remained ‘bearish’ over the last week, with some positive comments trickling in.

“$STUB recent IPO. Would be interested above the box. No rush,” said Greg Krupinski, a chartered market technician, pointing to a narrow trading area between $20 and $21.

“$STUB this will be north of $100 in first quarter next year,” said one user on the platform.

According to the company’s prospectus, it generated $397.6 million in revenue and $26.8 million in operating profit during the first quarter of this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<