Bitcoin prices rose to $114,776.10, Ethereum prices gained to $4,142.30, while XRP prices stood at $2.54 at the time of writing, according to CoinMarketCap data.

Major cryptocurrencies edged higher in early trading on Monday as U.S. President Donald Trump alleviated some concerns around the recent escalation of the trade dispute with China.

Bitcoin prices rose 3% to $115,220.16, Ethereum prices gained by 8.9% to $4,142.30, while XRP prices stood at $2.54 at the time of writing, according to CoinMarketCap data. Among other tokens, BNB was up 14% while Solana was up 7%.

The gains come after a brutal sell-off in digital currencies on Friday, following Trump’s announcement that the U.S. will impose 100% tariffs on China in response to Beijing’s rare earth export curbs. According to Coinglass data, concerns about a fresh trade war led to the largest crypto liquidation in history, with over $19 billion worth of leveraged positions erased in just 24 hours.

Over the weekend, both sides tried to ease the tensions. China’s Ministry of Commerce signaled that it was open to discussing the rare earth export curbs and other issues with the U.S., while Trump also indicated that he believes the two sides can resolve the dispute.

“Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want depression for his country, and neither do I. The USA wants to help China, not hurt it!!!” Trump said on Sunday in a Truth Social post.

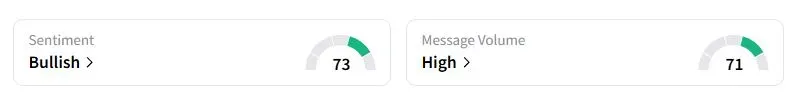

Retail sentiment on Stocktwits about Bitcoin was in the ‘bullish’ territory at the time of writing.

One optimistic user wrote that Bitcoin could still hit $140,000, soon.

According to SoSoValue data, spot Bitcoin ETFs logged outflows of $4.5 million on Friday. However, for the month, they have recorded inflows of close to $6 billion, aided by concerns around the U.S. economy and the prospects of monetary policy easing.

“We run it back turbo, the bull market is just as on fire as it was before the collapse,” investor Michael Van De Poppe said in a post on X.

Institutional Buyers Step In

According to the on-chain investigator Arkham Intelligence data, Marathon Digital Holdings, which holds about 52,850 Bitcoins (valued at over $6 billion), bought an additional 400 Bitcoins valued at about $45.9 million through FalconX in the early hours of Monday.

In earlier corrections this year, the crypto treasury companies have scooped up additional tokens by taking advantage of the lower prices.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<