Optimism over an India–US trade deal and easing geopolitical tensions boosted investor sentiment. Buying in real estate, pharma, and PSU banks offset weakness in metals and tech stocks.

Indian equity markets ended higher, with the Nifty index closing below 25,300, led by buying in real estate, pharma, and PSU banks. Metals and technology were the only indices to end in the red on Friday. Renewed optimism over a potential India–US trade deal before the November deadline, along with easing geopolitical tensions in the Middle East, aided investor sentiment.

Benchmarks ended higher for the second straight week, gaining over 1.5% and seeing their biggest weekly gains in three months.

On Friday, the Sensex closed 1098 points higher at 82,500, while the Nifty 50 ended up 103 points at 25,285. Broader markets mirrored the gains, with the Nifty Midcap index rising 0.4% and the Smallcap index gaining 0.6%.

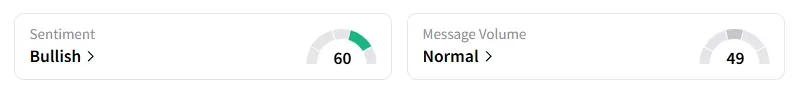

The retail investor sentiment surrounding the Nifty 50 remained ‘bullish’ by market close on Stocktwits.

Stock Moves

TCS was among the top Nifty losers, shedding 1% despite steady performance in the September quarter (Q2) earnings. Tata Communications surged 10% on a sentiment boost as TCS unveiled ambitious AI plans that included setting up a 1 GW data centre in India.

Weak Q2 performance dragged Tata Elxsi 3% lower.

Pharma stocks such as Divi’s Labs, Piramal Pharma, and Wockhardt gained between 3% and 5% after the US Senate passed the National Defense Authorisation Act (NDAA), which includes an amended version of the Biosecure Act. The legislation seeks to protect American biotech and health data from potential foreign threats, especially from Chinese firms.

Textile stocks such as Gokaldas, Indo Count surged over 5% on news reports that India-UK are likely to double trade by 2030

Man Industries surged 4% after the Securities Appellate Tribunal (SAT) granted a stay on SEBI’s order against the company, which directed it to deposit 50% of the imposed penalty.

And new entrant, WeWork India, ended over 2% lower after a muted listing on the bourses.

Stock Calls

Mayank Singh Chandel recommended buying LT Foods. The stock has found support at a rising trendline and is currently trading just below its 200-day Exponential Moving Average (EMA). In the past, the stock has bounced back from the 200 EMA or slightly below it, demonstrating strong support at this level, which makes the current price a good entry point.

He suggested entering at the current market price with a stop loss below ₹375. Short-term price target is set at ₹420, with a medium-term target at ₹500.

Kapil Aggarwal of InvestKaps recommended buying AMAL at the current price of ₹950-₹1,000 for a target of ₹1,200 and a stop loss of ₹900. The stock has seen a healthy, well-channeled correction and taken support around its 20-week EMA. It looks poised for an upmove to a new high.

Markets: What Next?

Globally, European markets traded mixed, while US stock futures indicate a subdued start on Wall Street as the US government shutdown is likely to extend into next week.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <