BIDU stock hit an over two-year high last week, amid a strong gains in Chinese tech stocks.

Macquarie analysts upgraded their rating on Baidu’s stock to ‘Outperform’ from ‘Neutral,’ and nearly doubled the price target to $176 from $91, according to a summary of the investor note on The Fly.

They argued that the company’s revenue stream is more diversified than before, with cloud services, AI chips, and robotaxis emerging as tangible drivers.

With China’s enterprise demand entering an inflection point, thanks to accelerated AI cloud adoption, Baidu is well-positioned to benefit, according to Macquarie.

Baidu’s U.S.-listed shares declined 2.5% in premarket trading on Friday, tracking the 5.7% drop in the Hong Kong stock.

Even as Alibaba has emerged as the poster boy of China’s tech sector recovery — its shares have more than doubled this year — Baidu is beginning to catch up.

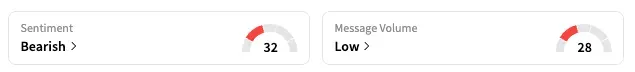

BIDU hit an over two-year high earlier this month, although the Stocktwits sentiment for the stock has remained in ‘bearish’ zone since the start of October.

Year-to-date, Baidu’s shares are up 60%.