Bitcoin was trading at $121,276.67 at the time of writing, while Ethereum dipped to $4,332.97, and XRP fell 0.3% to $2.80, according to CoinMarketCap data.

Major cryptocurrencies were down in early trading on Friday as investors wondered about the Federal Reserve’s next moves after private reports showed that U.S. jobless claims rose last week.

Bitcoin was trading at $121,276.67 at the time of writing, while Ethereum dipped to $4,332.97, and XRP fell 0.3% to $2.80, according to CoinMarketCap data. Among other tokens, BNB, Solana, and Cardano all declined compared to the previous day.

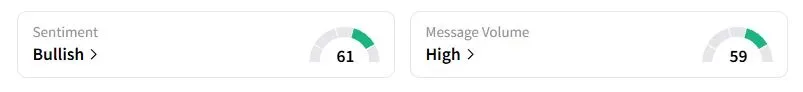

Retail sentiment on Stocktwits about Bitcoin was still in the ‘bullish’ territory at the time of writing.

The U.S. government remains shut as lawmakers have been unable to agree on a stopgap funding measure. The shutdown has kept hundreds of federal workers at home, delaying the release of key economic data, which Fed policymakers will likely take into account before their next meeting later this month.

According to a Reuters News report, private surveys showed that the number of Americans filing new applications for unemployment benefits rose again last week, likely indicating some early layoffs of contractors related to the U.S. government shutdown.

While the Fed minutes from September showed that there was a slim majority in favor of two 25-basis-point cuts in the Federal Open Market Committee’s October and December meetings, they also stated, “Participants stressed the importance of taking a balanced approach in promoting the committee’s employment and inflation goals.” The minutes showed that labor market weakness remained among the top concerns of the central bank.

“Probably, the markets are bottoming in the coming 1-2 days, and the fun is back on. I don’t think we’ll see a dip correction on Bitcoin, it’s also not the peak of the bull [run],” investor Michael Van De Poppe said.

According to SoSoValue data, Bitcoin ETFs logged $197.7 million in inflows on Thursday, extending a positive streak that began on Sept. 29.

Emergency Measures For CPI Report

Despite the federal government shutdown, the Bureau of Labor Statistics is recalling a limited number of workers to assist with the release of September’s consumer price data, The New York Times has reported, citing administration sources.

The report will likely be released before the Federal Reserve’s meeting, scheduled at the end of the month.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<