Rubicon Research IPO Day 2: The initial public offering (IPO) of pharmaceutical company Rubicon Research Ltd enters its second day of bidding process today, 10 October 2025. Rubicon Research IPO opened for subscription on October 9 and will close on October 13. Rubicon Research IPO GMP remains strong at more than 20% on the second day.

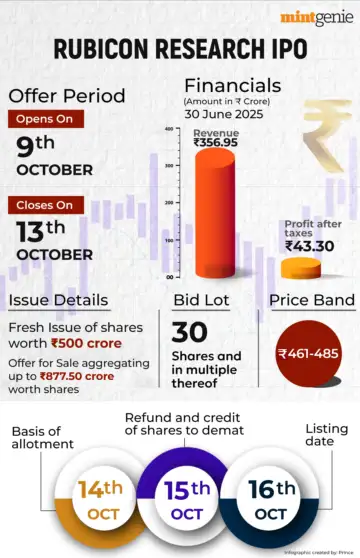

Rubicon Research IPO price band is set at ₹461 to ₹485 per share. The company aims to raise ₹1,377.50 crore from the public issue which is a combination of fresh issue of 1.03 crore equity shares worth ₹500 crore, and an offer-for-sale (OFS) of 1.81 crore shares aggregating to ₹877.50 crore. The company has already raised ₹619 crore from anchor investors ahead of its IPO.

Rubicon Research IPO allotment date is likely October 14, and the IPO listing date is October 16. Rubicon Research shares will be listed on both the stock exchanges, BSE and NSE.

Axis Capital Ltd. is the book running lead manager and MUFG Intime India Pvt. Ltd. is the Rubicon Research IPO registrar.

Rubicon Research is a pharmaceutical formulations player focused on innovation through research and development, building a growing portfolio of specialty and drug-device combination products. Its primary focus is on regulated markets, particularly the United States, making it the only Indian company in its peer group with a full focus on regulated markets.

Rubicon Research IPO Subscription Status

Rubicon Research IPO has been subscribed 69% so far till 10:40 AM on October 10, the second day of the bidding process, NSE data showed. The Retail Individual Investors (RIIs) category was booked 1.93 times, while the Non Institutional Investors (NII) segment was subscribed 71%. The Qualified Institutional Buyers (QIBs) category received 26% subscription so far.

Rubicon Research IPO GMP Today

Rubicon Research shares are witnessing a strong trend in the unlisted market, with a higher grey market premium. Rubicon Research IPO GMP today is ₹100 per share, market experts said.

Rubicon Research IPO GMP today signals the estimated listing price of the shares at over 20% premium to the issue price of ₹485 apiece.

Rubicon Research IPO Review

Rubicon Research reported robust financial performance with revenue growing from ₹393 crore to ₹1,284 crore from FY23 to FY25 with a CAGR of 80%, whereas PAT turned around from a loss of ₹17 crore to a profit of ₹134 crore in FY25.

“Rubicon Research IPO issue is over valued at 55x PE and 14x PB as compared to average of listed peers at 24x PE and 8x PB. The company is well poised for growth owing to its presence in the world’s largest pharma market US and its focus on the same market. The company has increased the number of specialty products from 3 in FY23 to 13 in FY25. With a high commercialization rate of 86.4% the company has demonstrated the effectiveness of its data driven product selection approach,” said Canara Bank Securities.

However, it noted high exposure to the US and changing global landscape around tariffs do raise a concern. Further the company derives 71% percent of revenue from top 5 customers as of FY25.

Canara Bank Securities recommend subscribing to the Rubicon Research IPO for investors with a high risk appetite.