The company announced a second interim dividend of ₹11 per share.

Tata Consultancy Services (TCS), India’s largest IT services company, has reported an earnings beat in the September quarter (Q2 FY26).

The IT bellwether reported a consolidated net profit of ₹12,075 crore. This slight decline was driven by a one-time restructuring cost of ₹1,135 crore booked during the period. On a year-on-year basis, profit rose 1.5% from ₹11,955 crore in Q2 FY25.

Revenue from operations came in at ₹65,799 crore. Growth was led by the Banking, Financial Services and Insurance (BFSI) segment, followed by Communications, Media & Technology, and Consumer Business.

Operating margin expanded by 70 basis points to 25.2%, while net margins stood at 19.6%

The company declared a second interim dividend of ₹11 per share, with October 15 as the record date, and payable on November 4.

TCS announced its ambition to become the world’s largest AI-led technology services company. This included significant investments such as establishing a new business entity for a 1 GW AI data center in India and acquiring ListEngage, a firm specializing in Salesforce.

The company reported total contract value (TCV) of $10 billion for the quarter, with multiple large deals across sectors.

Stock Watch

TCS shares ended 1% higher on Thursday, ahead of Q2 earnings print.

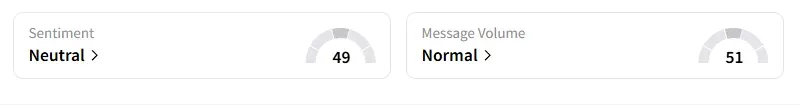

Data on Stocktwits shows retail sentiment has been ‘neutral’ for a week as of market close.

Year-to-date, the stock has declined 25%

For updates and corrections, email newsroom[at]stocktwits[dot]com.<