The analyst projects a strong technical breakout as retail sentiment shifts bullish after months of consolidation.

ITI shares surged 14% intraday on Wednesday after one of its biggest clients, Bharat Sanchar Nigam (BSNL), announced plans to accelerate its transition to 5G technology in India.

Telecom Minister Jyotiraditya Scindia recently announced that Bharat Sanchar Nigam’s indigenously developed 4G network is slated for a 5G upgrade within the next six to eight months.

ITI is a key player in providing telecom equipment and is likely to benefit from the upgrade from BSNL’s indigenous 4G network to 5G.

ITI has experienced a strong upward trend, supported by high trading volumes. Volumes are already the highest since December 2024. The stock has seen over 50% rally in the past six months.

The company has received orders and contracts in various states, including ₹1,901 crores from BSNL for the BharatNet project, as well as orders worth ₹88 crores in Odisha and Chhattisgarh, and contracts related to IT and network infrastructure projects.

The government owns 90% of this PSU telecom stock, with the Special National Investment Fund holding 8%

Technical Outlook

SEBI-registered analyst Financial Sarthis noted that the stock is attempting to break out of the mother candle formed on May 26. A decisive close above ₹369 can open the gates for ₹400, and once ₹400 is crossed and sustained, the next target zones are at ₹450 and ₹500. On the downside, strong support is identified around ₹275–₹280.

What Is The Retail Mood?

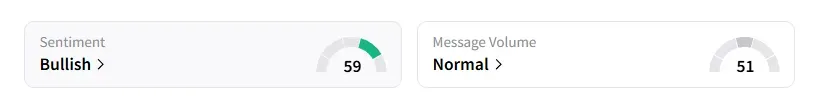

Data on Stocktwits shows that retail sentiment flipped to ‘bullish’ a day ago. It was ‘neutral’ last week.

ITI shares have declined 5% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<