The retail trading platform’s stock fell 6.6% during the regular trading session, the worst performance since late August.

Webull Corp’s stock garnered retail attention on Tuesday as investors debated whether the stock would dip and enter oversold levels after a shareholder lockup period ends later this week.

The retail trading platform’s stock fell 6.6% during the regular trading session, marking the worst performance since late August, and continued to slip in extended trading as concerns mounted about insider selling. According to a regulatory filing, on or about Oct. 8, 455.6 million Webull shares held by existing shareholders will become available for sale in the market after the expiry of a lock-up period.

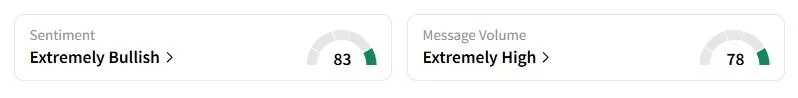

The prospect of insider selling sparked some concerns about valuation among traders. Retail sentiment on Stocktwits, however, about Webull moved into the ‘extremely bullish’ territory, compared with ‘neutral’ a day ago, and retail message volume jumped over 225%.

With the stock down about 12% over the past week, one trader noted that it is unlikely that insiders will offload shares now, given that peer Robinhood’s stock has risen this year. “There [are] not 20 execs getting ready to slam the sell button tomorrow at $12.80 when they can hold, run up the price, and sell for much more later,” the Stocktwits user noted.

“What’s the bear case here?? Some shares are being released? I mean, do we honestly believe the retail investors are not coming into the market in droves currently?” another user wrote.

Webull has more than 24 million registered users globally and entered the European market last month with the launch of brokerage services in the Netherlands. Last month, Rosenblatt Securities analysts praised Webull, noting that while it began as a specialized data platform, the company has transformed into the second-largest mobile-first brokerage in the U.S. It now offers a top-rated app and a comprehensive desktop service designed for active retail traders.

The brokerage also expected the company to sustain more than 25% annual revenue growth through 2027, far above forecasts. During the second quarter, the company, founded by Alibaba and Xiaomi veteran Wang Anquan, reported a 46% year-over-year increase in revenue to $131.5 million.

Webull stock is up over 10% this year following its merger with a blank-check firm in April.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<