- Bechmark outperformed Broder Market Indices

- Nifty ends below its crucial 25,000 mark.

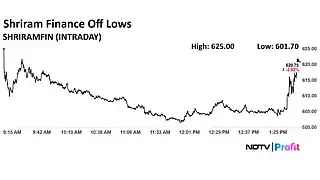

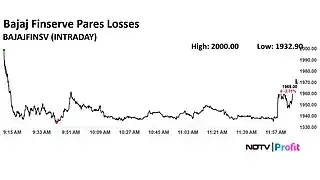

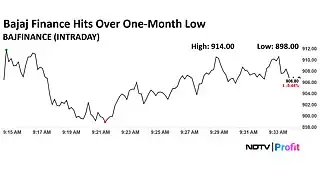

- Bajaj Finance and Shriram Finance fell the most in Nifty.

- Nifty Midcap 150 fell by 1.6% for the day, drag by APL Apollo Tubes and MRPL

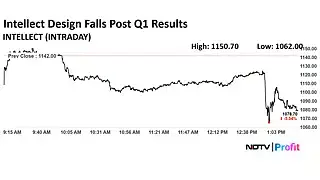

- Nifty smallcap 250 fell by more than 2% for the day, drag by Chennai Petroleum and Intellect Design

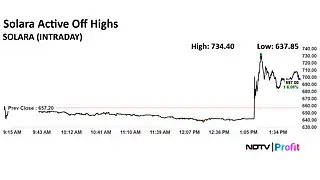

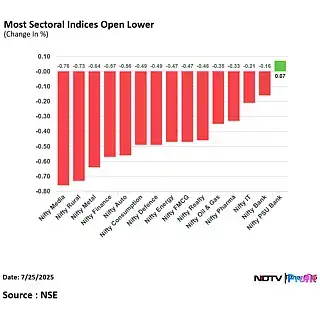

- All sectoral Indices ended lower barring Nifty Pharma

- Nifty Media emerges as the top losing sector for the day, drag by Zee Entertainment and Dish TV.

- Nifty Pharma gains for the 3rd consecutive day.

- Nifty FMCG fell for the 6th consecutive day.

- Nifty Realty fell for the 4th consecutive day.

- Nifty Auto snaps 2 day gaining streak.

- Rupee closed 11 paise weaker at 86.52 against US Dollar

- It closed at 86.41 a dollar on Thursday

Source: Cogencis

Bharat Electronics Ltd. received an order worth Rs 1,640 crore from Indian Army for Air Defence Fire Control Radars

Bharat Electronics Ltd. received an order worth Rs 1,640 crore from Indian Army for Air Defence Fire Control Radars

Kansai Nerolac Paints Limited appoints Mr. Yash Ahuja as Chief Financial Officer effective August 1, 2025.

Q1 Results Key Highlights (Consolidated, YoY)

- Net Profit at Rs 10.5 crore versus loss of Rs 13.5 crore

- Revenue down 12.2% at Rs 319 crore versus Rs 364 crore

- Ebitda up 36% at Rs 57 crore versus Rs 41.9 crore

- Margin at 18% versus 11.5%

Hexaware Technologies’ margins slumped 400 basis points. The company is expecting growth improve from third quarter. Its Ebit fell 27.54% at Rs 328.5 crore versus Rs 453.4 crore.

Hexaware Technologies’ margins slumped 400 basis points. The company is expecting growth improve from third quarter. Its Ebit fell 27.54% at Rs 328.5 crore versus Rs 453.4 crore.

Shriram Finance Result Highlights (Consolidated YoY)

Shriram Finance Result Highlights (Consolidated YoY)

- Net profit up 6.3% at Rs 2,159 crore versus Rs 2,030

- Net Interest Income At Rs 5,773 crore, Up 10%

Intellect Design Q1 Highlights (Consolidated QoQ)

Intellect Design Q1 Highlights (Consolidated QoQ)

- Revenue down 3.34% at Rs 701.68 crore versus Rs 725.9 crore

- EBIT down 47.34% at Rs 95.19 crore versus Rs 180.78 crore

- Margin down 1133 bps at 13.56% vs 24.9%

- Net profit down 30.17% at Rs 94.48 crore versus Rs 135.31 crore

Bajaj Finserv Earnings Highlights (Consolidated, YOY)

Bajaj Finserv Earnings Highlights (Consolidated, YOY)

- Net Profit up 22.6% at Rs 2,540 crore versus Rs 2,072 crore

- Total Income up 12.6% at Rs 35,439 crore versus Rs 31,479 crore

Track live updates on Q1 earnings here.

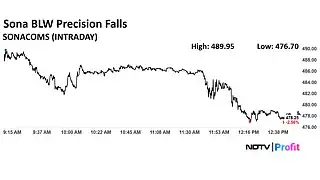

Sona BLW Precision Forgings Ltd. share price fell nearly 3% in Friday session controversies stirred after foremer Chairperson Rani Kapur sought determent of annual general meeting. She has alleged coercion, document misuse, attempts to usurp family legacy after Sanjay Kapur’s death, ANI reported.

Sona BLW Precision Forgings Ltd. share price fell nearly 3% in Friday session controversies stirred after foremer Chairperson Rani Kapur sought determent of annual general meeting. She has alleged coercion, document misuse, attempts to usurp family legacy after Sanjay Kapur’s death, ANI reported.

Indian markets are likely to become narrow before any signs of full-blown revival comes. Re-starting of private capital expenditure cycle will ensure the beginning of another momentum, according to Old Bridge Capital Founder and Chief Investment Officer Kenneth Andrade said. “Indian markets are at place where it is most likely to continue to perform positively,” he said.

Indian markets are likely to become narrow before any signs of full-blown revival comes. Re-starting of private capital expenditure cycle will ensure the beginning of another momentum, according to Old Bridge Capital Founder and Chief Investment Officer Kenneth Andrade said. “Indian markets are at place where it is most likely to continue to perform positively,” he said.

Read the full article here.

The NSE Nifty 50 and BSE Sensex declined as much as 1% and 0.9%, respectively so far today.

Late businessman Sanjay Kapur’s mother Rani Kapur is seeking a determent of today’s annual general meeting of Sona BLW Precision Forgings Ltd. from the board. She has alleged coercion, document misuse, attempts to usurp family legacy after Sanjay Kapur’s death, ANI reported.

Late businessman Sanjay Kapur’s mother Rani Kapur is seeking a determent of today’s annual general meeting of Sona BLW Precision Forgings Ltd. from the board. She has alleged coercion, document misuse, attempts to usurp family legacy after Sanjay Kapur’s death, ANI reported.

The board meeting is scheduled for today.

GAIL (India) Ltd. has received approval from PNGRB to expand the capacity of its Jamnagar-Loni Petroleum Pipeline. The pipeline’s capacity will be increased from 3.25 Million Metric Tonnes Per Annum. to 6.5 MMTPA.

This expansion aims to enhance energy transportation efficiency across the western and northern regions.

Symphony’s Board has approved the divestment of its stake in its Australian subsidiary, Climate Tech. The decision was disclosed through an official exchange filing.

In Friday’s trading session, Osho Krishan, Chief Manager, Technical & Derivative Research at Angel One, recommended three stocks for short-term buying opportunities. Sona BLW Precision Forgings Ltd, Cipla Ltd, and PG Electroplast Ltd. Krishan has provided specific entry levels, stop-loss thresholds, and target prices for traders looking to capitalise on near-term momentum.

The NSE Nifty 50 index relative strength index hit the lowest level since April 9. It is at at 41.8.

The RSI is a momentum indicator. Low RSI values indicate oversold market conditions.

Canara Bank’s limited standard provision buffers and modest core profitability metrics limit valuations for us, though low delinquencies and improved provision coverage ratio provide comfort, according to Dolat Reserach Capital. The brokerage values the bank at 1x FY27E ABV, with a target price of Rs 125.

Read the full research report here.

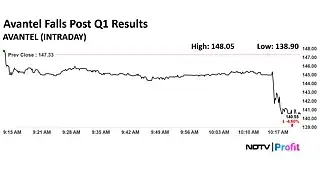

Avantel share price declined 6.26% to Rs 138.90 apiece after it reported a 56.3% on year fall in its net profit during April-June.

Shares of liquor companies fell in early trade on Friday after India and the United Kingdom signed a landmark free trade agreement (FTA) that includes steep reductions in import duties on Scotch whisky and gin. The pact, which marks India’s first major FTA in over a decade, triggered a cautious reaction from investors amid concerns over pricing dynamics and competitive pressures in the premium alcohol segment.

Shares of liquor companies fell in early trade on Friday after India and the United Kingdom signed a landmark free trade agreement (FTA) that includes steep reductions in import duties on Scotch whisky and gin. The pact, which marks India’s first major FTA in over a decade, triggered a cautious reaction from investors amid concerns over pricing dynamics and competitive pressures in the premium alcohol segment.

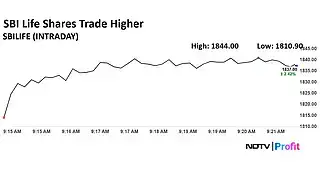

Shares of SBI Life Insurance Co. rose over 2% on Friday after the insurer company announced its first quarter results for the fiscal 2025-26.

SBI Life Insurance Co.’s net profit rose 14.4% year-on-year in the April-June quarter. The insurer posted a bottom-line of Rs 594 crore in the quarter ended June 30, 2025, according to an exchange filing on Thursday. In the year-ago period, the company posted a net profit of Rs 520 crore.

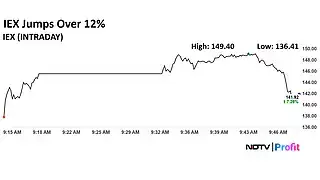

Indian Energy Exchange Ltd. share price hit a 10% upper circuit in Friday’s session as it reported a decent increase in its net profit. The company’s consolidated net profit advanced 25% on the year to Rs 121 crore from Rs 96.4 crore.

Indian Energy Exchange Ltd. share price hit a 10% upper circuit in Friday’s session as it reported a decent increase in its net profit. The company’s consolidated net profit advanced 25% on the year to Rs 121 crore from Rs 96.4 crore.

Shares of Bajaj Finance Ltd. fell 6.15% on Friday the most since Jan. 5, 2023, after the company posted its first quarter results for financial year 2026. The stock came under pressure as its asset quality showed signs of strain. Gross non-performing assets rose to 1.03% from 0.96% in the previous quarter, while net NPA increased to 0.5% from 0.44%.

Shares of Bajaj Finance Ltd. fell 6.15% on Friday the most since Jan. 5, 2023, after the company posted its first quarter results for financial year 2026. The stock came under pressure as its asset quality showed signs of strain. Gross non-performing assets rose to 1.03% from 0.96% in the previous quarter, while net NPA increased to 0.5% from 0.44%.

On National Stock Exchange, 14 sectoral indices slumped, while NSE Nifty PSU Bank advanced. The NSE Nifty Media was the worst performer.

On National Stock Exchange, 14 sectoral indices slumped, while NSE Nifty PSU Bank advanced. The NSE Nifty Media was the worst performer.

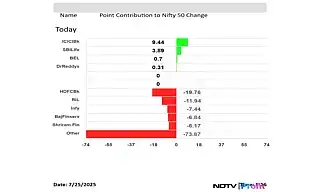

HDFC Bank Ltd., Reliance Industries Ltd., Infosys Ltd., Bajaj Finserve Ltd., and Shriram Finance Ltd. weighed on the Nifty 50 index.

HDFC Bank Ltd., Reliance Industries Ltd., Infosys Ltd., Bajaj Finserve Ltd., and Shriram Finance Ltd. weighed on the Nifty 50 index.

ICICI Bank Ltd., SBI Life Insurance Co. Ltd., Bharat Electronics Ltd., and Dr. Reddy’s Laboratories Ltd. limited losses in the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex declined sharply at open on Friday as Reliance Industries Ltd. dragged. The indices were trading 0.55% and 0.50% down, respectively as of 9:23 a.m.

The NSE Nifty 50 and BSE Sensex declined sharply at open on Friday as Reliance Industries Ltd. dragged. The indices were trading 0.55% and 0.50% down, respectively as of 9:23 a.m.

- The 10-year bond yield opened flat at 6.37%

Source: Cogencis

- Rupee opened 16 paise weaker at 86.57 against US Dollar

- The opening level is the lowest since June 23

- It closed at 86.41 a dollar on Thursday

Source: Cogencis

DLF Home Developers and Trident Realty have announced a complete sellout of Phase 1 of their Mumbai project, ‘The Westpark’. The project has clocked over Rs 2,300 crore in sales, as per the exchange filing.

- Maintain a Hold with a target price of Rs 2,350

- A miss in Q1 results

- Near equal contribution from volumes and realisation

- With an exception of milk & nutrition, growth was actually respectable and quick commerce drove share of e-comm

- Contraction in gross margin consequent to firm input prices impacted Ebitda

- Cut EPS by 4-5%

Oil prices continued to rise on optimism over US trade deals with key trade partners. The brent crude was trading 0.52% higher at $69.55 a barrel as of 8:18 a.m.

Markets in most Asia-Pacific countries were trading in losses on Friday as traders parse recent development on trade tariffs and deal with uncertainty over US Federal Reserve’s policy outlook.

The MSCI Asia-Pacific index snapped a six-day winning streak. The index was down 0.75% as of 8:16 a.m.

The S&P 500 and Nasdaq 100 futures advanced along with most US stock indices’ futures. S&P 500 and Nasdaq 100 hit record highs in Thursday’s session as Google’s parent Alphabet Inc.’s robust earnings restored faith in technology stocks.

The GIFT Nifty was trading 0.04% or 9.50 points higher at 24,977.50 as of 6:45 a.m., which implied a higher open for the benchmark Nifty 50 index.

Bajaj Finance Ltd., Indian Energy Exchange Ltd., Tanla Platforms, Sun Pharmaceutical Industries Ltd., Kfin Technologies Ltd. share prices will be in focus in Friday’s session.

The benchmark equity indices closed lower on Thursday, weighed down by shares of Reliance Industries Ltd., Infosys Ltd. and HDFC Bank Ltd.

The NSE Nifty 50 ended 157.8 points or 0.63% lower at 25,062.1, while the BSE Sensex closed 542.47 points or 0.66% down at 82,184.17.