JLR to introduce a short-term financing scheme to provide immediate liquidity to suppliers

Tata Motors’ British unit, Jaguar Land Rover (JLR), has announced the phased restart of its operations and the launch of a new supplier financing programme, marking a major step toward normalcy following the cyber incident in early September that disrupted production.

The company will begin ramping up production on October 8, starting with its Electric Propulsion Manufacturing Centre and Battery Assembly Centre in the West Midlands, UK.

Employees will also return to key operations at Castle Bromwich, Halewood, and Solihull, including the body, paint, and logistics units that support JLR’s global manufacturing network. Vehicle assembly will follow shortly at the Nitra (Slovakia) plant and the Range Rover and Range Rover Sport lines in Solihull.

To stabilize its supply chain, JLR is introducing a short-term financing scheme to provide immediate liquidity to qualifying suppliers. This initiative allows early prepayments, up to 120 days faster than standard terms, with JLR covering financing costs during the restart phase. The scheme will initially focus on production-critical suppliers before expanding to others.

These measures follow JLR’s efforts to improve its liquidity in September and implement manual payment systems to support suppliers following the incident.

The company said it remains focused on returning to full-scale manufacturing and strengthening supplier partnerships in the weeks ahead.

Staring At A Hefty Loss

Last month, reports stated that JLR could bear the full financial impact of the cyberattack due to a lack of insurance coverage. JLR was forced to shut down its IT systems on September 1, halting production across its UK plants and disrupting operations in manufacturing, retail, and the supply chain. The plants, which normally produce about 1,000 cars per day, have remained idle for over a month, affecting 33,000 employees.

Reports suggest weekly losses of nearly £50 million, implying potential damages of around £2 billion, exceeding JLR’s FY2025 profit.

Stock Watch

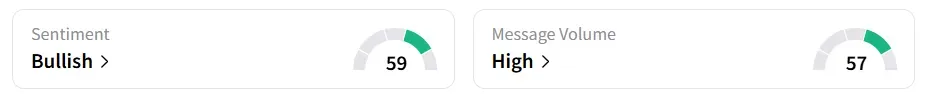

On Stocktwits, retail sentiment shifted to ‘bullish’ from ‘neutral’ a day earlier, amid ‘high’ message volumes.

Tata Motors shares have gained around 1% since the cybersecurity breach was first announced. Year-to-date, the stock has shed 6.8%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<