Topline slowdown and weakening same-store sales have led analysts to caution that sustaining its earlier growth pace will be challenging.

Shares of Trent fell nearly 4% on Tuesday, making it the top decliner on the Nifty 50 index. The stock has been on a downtrend lately, declining in 10 of the past 13 sessions.

Trent reported that its Q2FY26 standalone revenue is expected to grow 17% to ₹5,002 crore, marking its slowest quarterly growth since March 2021. First-half revenue rose 19% to ₹10,063 crore, falling short of the company’s long-term 25% growth target and lagging the 20% increase seen in Q1, amid rising competition in fashion and lifestyle retail.

Brokerage Cuts

While Morgan Stanley maintained an ‘Overweight’ rating, it cut its target price to ₹5,892, noting the sharp deceleration in revenue growth. However, Morgan Stanley projects the standalone EBITDA margin to expand 165 bps to 17.3% in FY26.

Domestic brokerage Equirus downgraded Trent to ‘reduce’ from ‘add’ and cut its target to ₹4,474, citing signs of growth fatigue. It highlighted that the second quarter marks the fifth consecutive slowdown, with 17% revenue growth, the slowest in 18 quarters, and warned that achieving the earlier 26% topline CAGR over FY25–27 will be challenging.

Motilal Oswal, however, maintained a buy call, noting that store additions in the second half will remain a key growth driver amid weakening same-store sales.

Technical View

Trent’s stock is currently in a downtrend, showing weakness on the charts, noted SEBI-registered Financial Sarthis.

A weekly close below ₹4,680 could trigger further declines toward ₹4,500 and ₹4,200. The trend will only turn positive if the stock sustains above ₹5,000, he added.

Meanwhile, Frontwave Research highlighted that Trent’s stock remains in a medium-term downtrend, with immediate support located near ₹3,920 and stronger support around ₹3,500, which corresponds to the 200-week moving average.

A sustained move above ₹5,000 will be needed to signal a reversal, while any close below ₹4,680 could accelerate downside momentum.

The next bullish trigger will likely depend on upgraded growth guidance or a fresh catalyst for expansion, they added.

What is the Retail Sentiment?

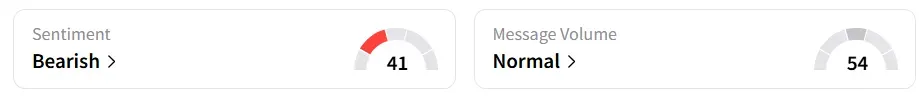

Retail sentiment on Stocktwits turned ‘bearish’ from ‘neutral’ a day earlier.

Year-to-date (YTD), the stock has shed 34%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<