In a post on X, OpenAI CEO Sam Altman said the company’s partnership with AMD is incremental to its ongoing work with Nvidia.

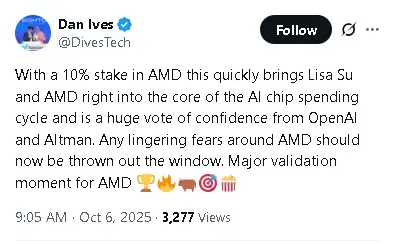

Wedbush’s Dan Ives said Monday that AMD has received a “major validation moment” with OpenAI targeting a 10% stake in the company, placing AMD at the center of the AI chip spending cycle.

“This is a huge vote of confidence from OpenAI and Altman,” Ives wrote on X. “Any lingering fears around AMD should now be thrown out the window.” AMD’s stock price rose 32% at market open.

On Monday, OpenAI CEO Sam Altman stated on X that the company is excited to partner with AMD, noting the collaboration is incremental to its ongoing work with Nvidia (NVDA). Altman added that OpenAI plans to continue increasing Nvidia purchases over time. However, Nvidia’s stock price dipped more than 2% at market open.

Earlier on Monday, AMD and OpenAI announced a six-gigawatt agreement to power OpenAI’s AI infrastructure with AMD chips. The first gigawatt deployment of AMD Instinct MI450 GPUs is scheduled for the second half of 2026. Under the agreement, AMD issued OpenAI a warrant for up to 160 million shares of AMD common stock, structured to vest as milestones are achieved.

CEO Lisa Su said that there is “nothing exclusive” about the OpenAI deal, and AMD is positioned to supply all customers interested in the MI450. She added that AMD expects to deploy the first gigawatt “as soon as possible.”

Meanwhile, shares of Sanmina (SANM) also jumped nearly 24% at market open, following the announcement. Sanmina previously acquired AMD’s data center infrastructure business from ZT Systems and will work alongside AMD to support the rollout of AI chips.

Read also: BNB Hits All-Time High, Leads Altcoin Rally After Bitcoin’s Weekend Surge Lifts Crypto Market To Record

For updates and corrections, email newsroom[at]stocktwits[dot]com.<