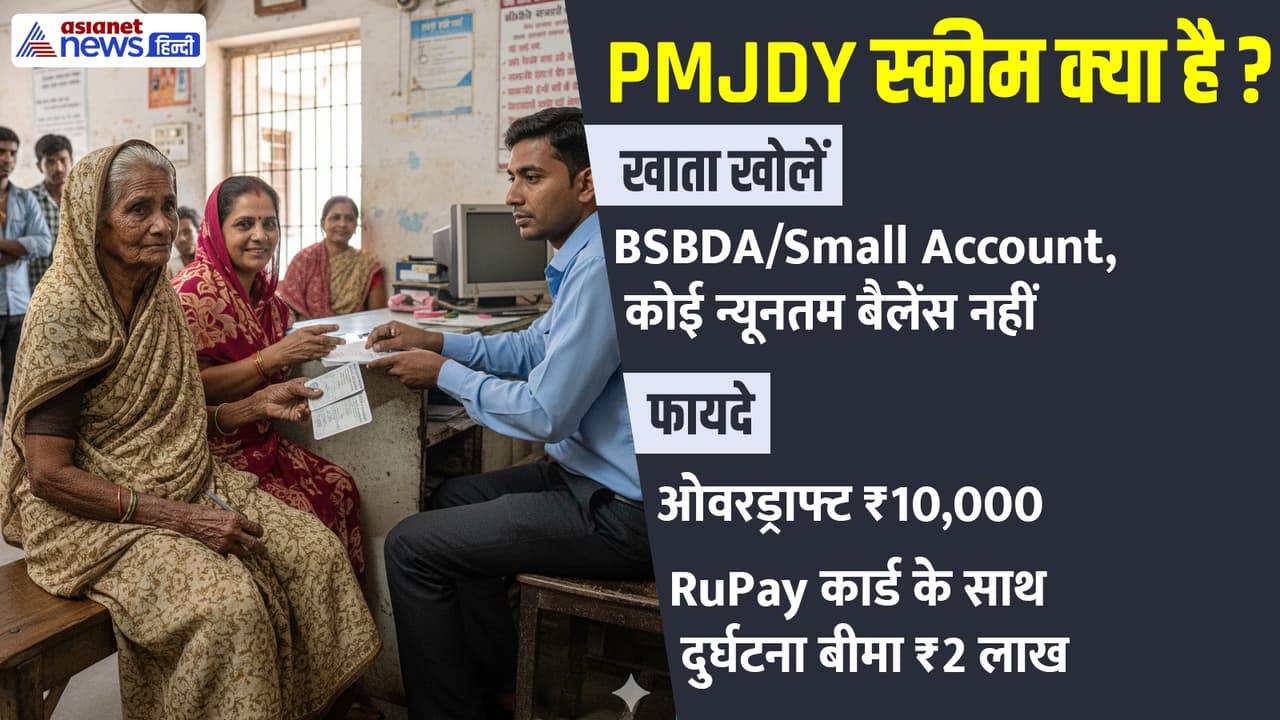

Jan Dhan Account Benefits: It is very easy for every Indian citizen to open a bank account under the Pradhan Mantri Jan Dhan Yojana (PMJDY). Learn how to open BSBDA, what is the qualification for this? How to get rupay debit card, overdraft facility, accident insurance benefit.

Pradhan mantri jan dhan yojana: In August 2014, Prime Minister Narendra Modi launched the Pradhan Mantri Jan Dhan Yojana (PMJDY) to promote Financial Inclusion in India. Its main objective was to reach banking facilities to every citizen of the country and they could easily handle their financial activities. The focus of PMJDY was earlier on opening a bank account in every household, but now it has been increased to every unbanked adult citizen. The objective of the scheme is to include people without banking access to banking, secure unsafe people, provide financial assistance to people needing grants and to provide services to far-flung areas.

What are the benefits received under Pradhan Mantri Jan Dhan Yojana?

Basic Savings Bank Account (BSBDA,

Every Indian citizen, who is eligible to open an account, can open Basic Savings Bank account without minimal balance under PMJDY. Through this, money deposits and withdrawal becomes easier. But it has to be kept in mind that you cannot withdraw more than four times in a month.

Small account or chota khata

Small bank accounts can also be opened in PMJDY, which does not require any major document. This account remains valid for 12 months and if you submit a valid document in 12 months, it can be extended for the next 12 months.

Rupay debit card and accident insurance

PMJDY account holders are given free rupay debit cards. This includes the accident insurance cover 2 lakh (which is ₹ 1 lakh for the account opening before 28 August 2018).

OD Facility

Under PMJDY, you can also get an overdraft facility of up to Rs 10,000, which gives immediate money at the required time.

Business Correspondents or Bank Friends (BCS, Bank Mitras)

Bank branches in far-flung villages provide services to friends due to low bank branches. These people provide facilities like opening an account, deposit-nickel, mini statement.

Also read- Vocational Education Loan Scheme: 4 lakh loans for courses from 6 months to 2 years, how to apply?

Who can open PMJDY account?

- The applicant should be an Indian citizen.

- Children above 10 years can open an account, but their legal guardian consent is necessary.

What is the process of opening of Pradhan Mantri Jan Dhan Yojana account?

- First go to the official website of PMJDY.

- Now click on the Account Opening Form in the E-Documes section. You can download it in Hindi or English.

- Download the form and remove the print.

- Fill all your information in the form like bank branch, village or city, block or district, Aadhaar number, profession, annual income etc.

- Submit the form to the nearby bank branch.

Which documents are necessary to open a PMJDY account?

- Aadhaar card

- Voter ID or PAN or Ration Card

- Permanent address proof (Driving License or Utility Bill)

- Passport Size Photo

- Filled and signed PMJDY account form

- Other Government notified documents

What have been changed in PMJDY?

- The overdraft limit has been increased from Rs 5,000 to Rs 10,000.

- Accident insurance of Rupay card holders has been increased from 1 lakh to 2 lakh rupees.

- PMJDY has greatly promoted banking access to the country and has made banking easy and reliable for economically weaker sections.

Also read- Rajasthan students a chance to study abroad: Government will give 10 lakhs every year, who can apply?