New Delhi: India’s telecom market is adding new mobile users at a steady pace, but the old wireline base continues to fall. The latest subscription data released by the Telecom Regulatory Authority of India (TRAI) for August 2025 shows how public sector player Bharat Sanchar Nigam Limited (BSNL) is fighting to stay relevant in both broadband and mobile services.

While Reliance Jio and Airtel dominate the charts with hundreds of millions of users, BSNL’s figures reveal the challenge of holding ground in a market that is rapidly shifting to wireless. Remember the long copper wire that connected our home phone during school days. It rang with a distinct sound, but those phones are now part of history for most Indian families.

India added 4.51 million new telecom subscribers in August 2025. | Source TRAI

BSNL’s position in broadband

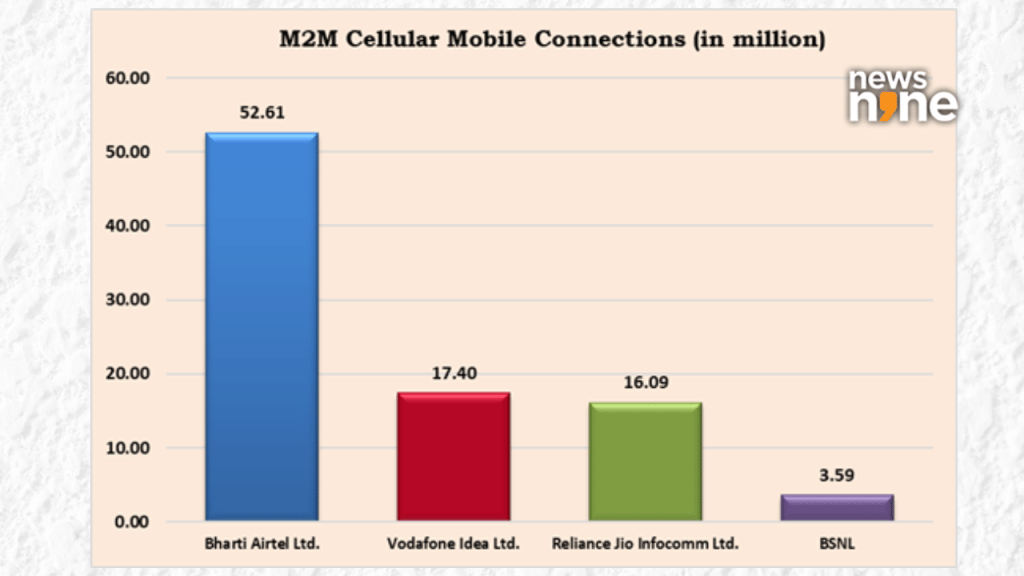

According to TRAI, India had 989.58 million broadband subscribers by August end. Out of this, BSNL accounted for 34.31 million, making it the fourth largest broadband provider after Jio, Airtel, and Vodafone Idea.

In the wired broadband category, BSNL still managed 4.38 million users, ahead of many regional players. But its market share is shrinking as fiber broadband from Jio and Airtel expand rapidly. In wireless broadband, BSNL had about 29.93 million users. When compared to Jio’s 488.31 million and Airtel’s 299.54 million, the gap looks massive.

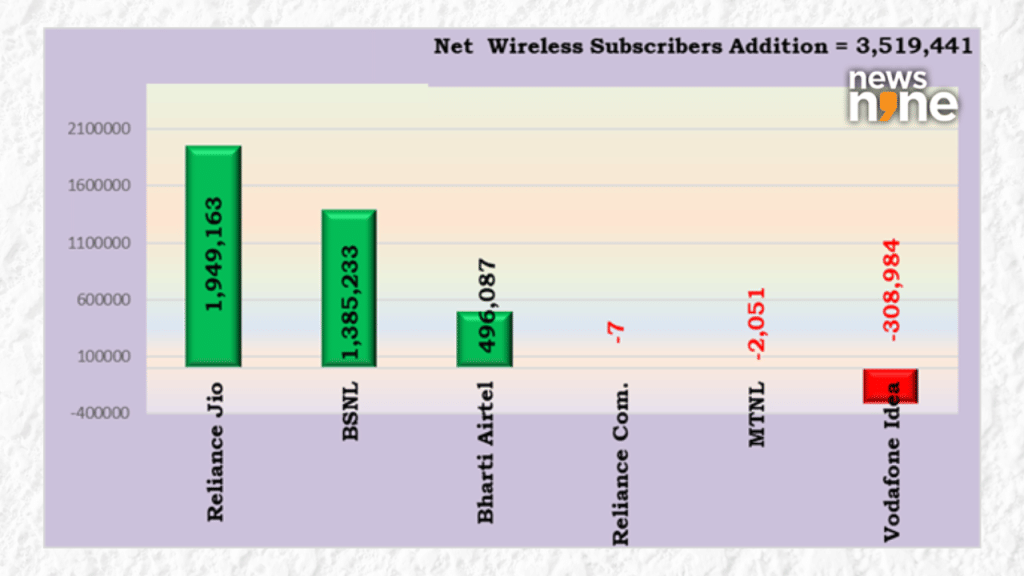

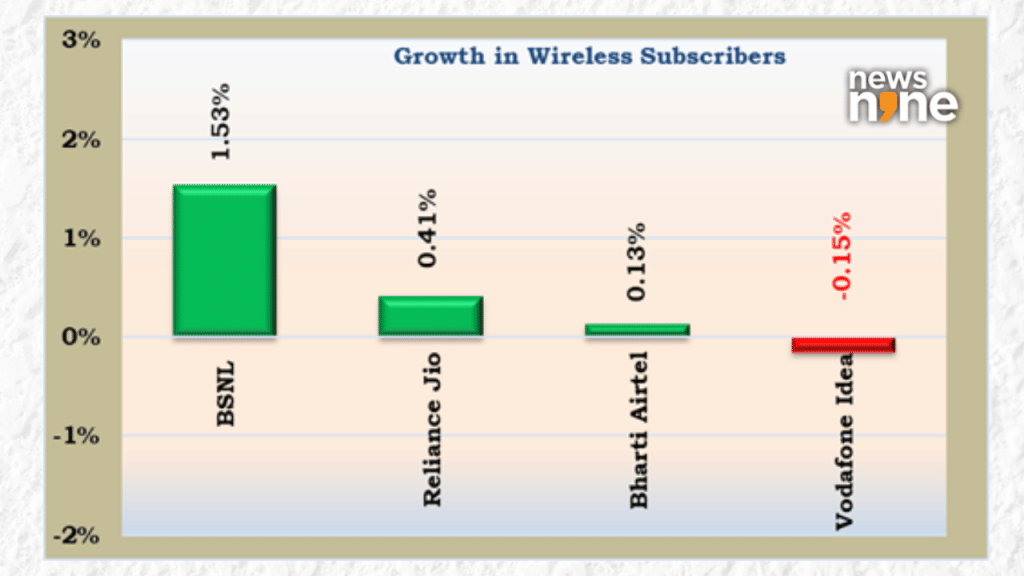

BSNL adds wireless users in August 2025 numbers | Source TRAI

Wireline decline continues

The overall wireline subscriber base in India dropped from 48.11 million in July to 46.51 million in August 2025. BSNL, along with MTNL and APSFL, together held 20.53% of this market. TRAI data shows wireline connections in rural India are very low, only 0.55% tele-density compared to 8.13% in urban areas.

This decline has been visible for years, but it still hits BSNL the hardest since its legacy network is heavily dependent on landline users. A monthly drop of -3.34% in wireline subscribers shows how quickly people are abandoning these connections.

BSNL faces landline decline, adds wireless users in August 2025 numbers | Source: TRAI

Mobile numbers offer some hope

Despite wireline losses, wireless subscriptions are climbing. The total wireless base in India went up to 1178.03 million in August, with urban users at 645.27 million and rural users at 532.76 million.

BSNL’s share in this space is small compared to private players. As TRAI noted, “private access service providers held a market share of 92.11% of the wireless subscribers, whereas PSU providers viz. BSNL and MTNL together held 7.89%.”

Still, BSNL has managed to grow its 5G fixed wireless access (FWA) base. It added new subscribers in August, though the numbers remain far behind private companies.

High churn and MNP requests

Another problem is customer churn. TRAI reported that 15.05 million subscribers submitted requests for mobile number portability (MNP) in August 2025. Many of these requests were from states like Uttar Pradesh East and Madhya Pradesh. For BSNL, keeping customers from switching to faster networks is a constant battle.

What it means for BSNL

The story of BSNL is both about survival and adaptation. On one side, its landline base is shrinking fast. On the other, it is still holding on to a significant number of broadband and wireless users. Whether it can compete in the 5G era will depend on how quickly it modernises.

For now, BSNL continues to be part of India’s telecom landscape, though its role looks very different from two decades ago. Back then, almost every Indian household knew its fixed-line number by heart. Today, most people only remember BSNL when they see its logo at a rural exchange or hear about a new fiber rollout.