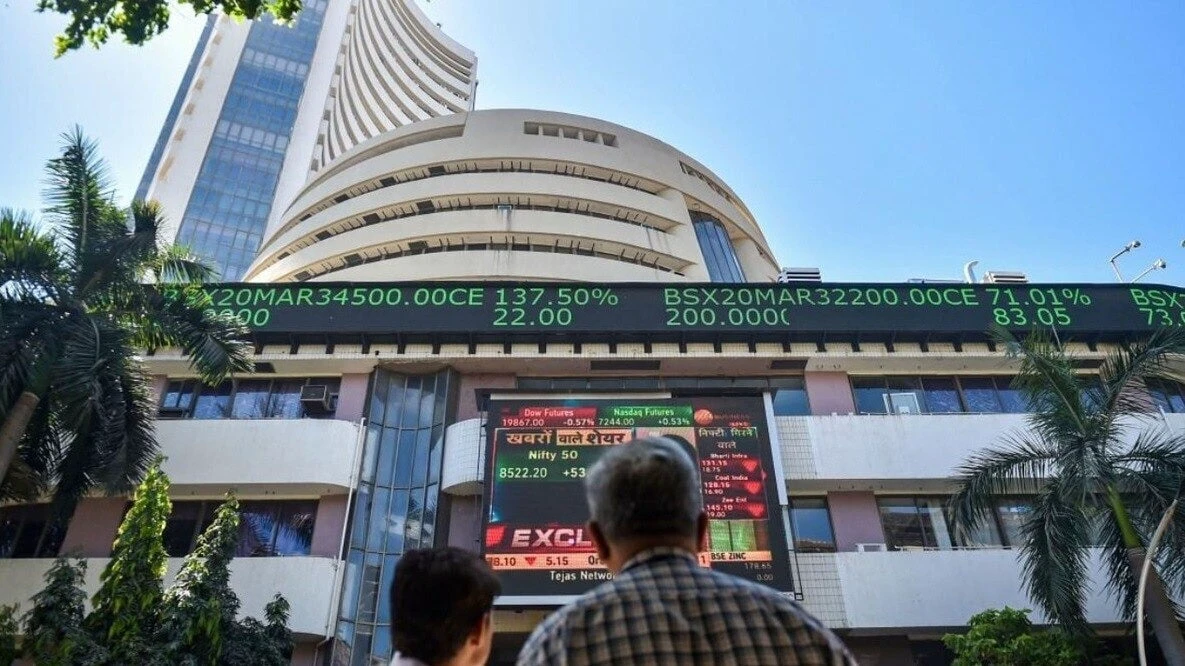

Benchmark stock market indices opened flat on Monday as IT sector and PSU banking stocks fell in early trade. RIL shares also fell nearly 2%, dragging the markets down.

The S&P BSE Sensex was down by 130.29 points to 81,627.44, while the NSE Nifty50 lost 48.95 points to 24,919.45 as of 9:22 am.

Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited, said that the single most important factor which the market will be focusing on in the coming days will be the outcome of the trade talks between the US and India.

“If an interim trade deal between the two countries is reached with a tariff rate of less than 20 % on India, that would be a positive from the market perspective,” he added.

The stock market started weak on Monday, with many top companies falling just after the opening bell.

The biggest losers in erly trade were Reliance Industries, which dropped by 1.95%, followed by Axis Bank, down 1.72%. Mahindra & Mahindra slipped 1.17%, Infosys fell 1.04%, and HCL Technologies declined by 0.97%.

However, a few stocks opened in green. Tata Steel led the gainers with a rise of 1.60%. HDFC Bank was next, gaining 1.34%, followed by Eternal at 1.11%. ICICI Bank added 0.80%, and UltraTech Cement rose by 0.53%.

The Nifty Midcap100 fell 0.37% while Nifty Smallcap100 declined 0.52%, but India VIX jumped 2.17%.

Among the sectoral indices, only a few showed positive momentum with Nifty Pharma leading at 0.59%, followed by Nifty Metal at 0.47% and Nifty Financial Services at 0.14%. Nifty Private Bank remained flat with no change.

Nifty Oil & Gas faced the biggest decline at 1.14%, followed by Nifty PSU Bank which dropped 0.88% and Nifty IT at 0.86%. Other losers included Nifty Auto at 0.62%, Nifty Healthcare at 0.58%, Nifty Media at 0.56%, Nifty FMCG at 0.51%, Nifty Consumer Durables at 0.38%, and Nifty Realty at 0.19%.

“Weekend Q1 results were good with ICICI Bank reporting the best numbers, particularly in PAT and credit growth. HDFC Bank also reported steady set of numbers. In the banking results, so far, Axis Bank’s numbers are the most disappointing,

said Vijayakumar.