Nike’s growth in key categories such as running puts pressure on rival brands like Lululemon and On Running, analysts say.

Nike drew a string of analyst upgrades as the stock posted its best day since late June on Wednesday, buoyed by strong earnings.

Nike reported better-than-expected quarterly results on Tuesday, driven by strong performance in its core North American market and its running-focused sportswear line, highlighting gains from CEO Elliott Hill’s revival strategy.

KeyBanc upgraded its rating on Nike shares to ‘Overweight’ from ‘Sector Weight’ and set its price target to $90, according to a summary of the research firm’s note on the Fly.

“The turnaround is well underway,” Bank of America analysts said in a note, and reiterated its ‘Buy’ rating and $84 price target on the stock.

Since the earnings report, several brokerages, including JPMorgan, Morgan Stanley, Jefferies, and Barclays, have raised their price targets. Of them, JPMorgan and Jefferies have a ‘Buy’ or equivalent ratings.

The “sleeping bear awakens,” analysts at Jefferies said in their investor note, implying that Nike’s turnaround efforts were showing results.

Nike stock gained 6.4% on Wednesday, recording its best day since Jun. 27, and taking the year-to-date performance within touching distance of break-even (shares are down 0.3% YTD).

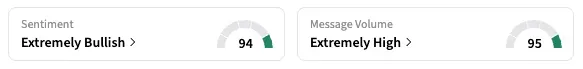

On Stocktwits, the retail sentiment for NKE held in the ‘extremely bullish’ zone, unchanged since Monday. “Will start buying for a long-term position,” said one user.

Jefferies analysts said that strong sales of Nike running shoes suggest pressure on challenger brands like On Running (ONON). Similarly, a weak China business signals a threat to other athleticwear brands, such as Lululemon, which has set an ambitious growth target for next year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<