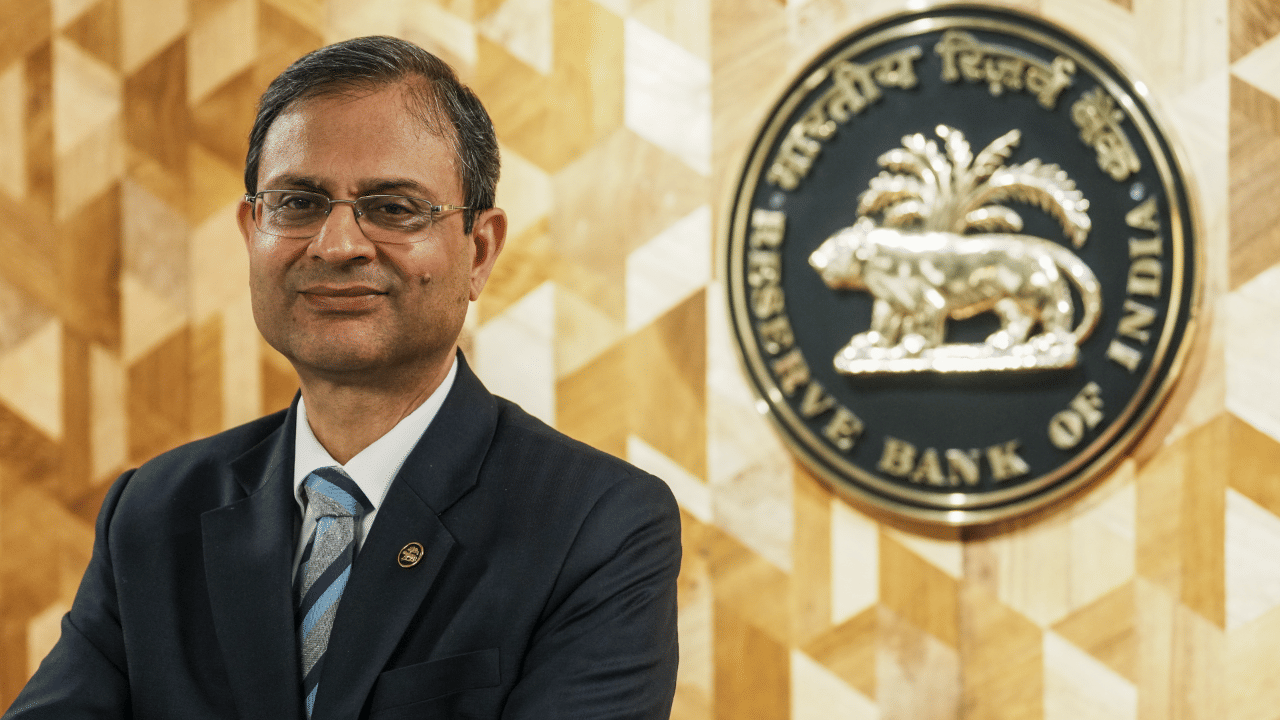

Kolkata: The Reserve Bank of India (RBI) Monetary Policy Committee (MPC) unanimously decided to maintain the policy Repo Rate at unchanged at 5.5% which effectively means that the interest rates on loans before the festive season peaking before Diwali will not come down. RBI governor Sanjay Malhotra saying that the impact of GST rejig and fiscal measures are still paying out and they would like to wait for the full impact before initiating any step. The policy stance of the central bank will also continue to be neutral, he said.

Since the GST rejig has brought down the prices of a large number of items of daily use, a rate cut at this stage could have turbo-charged consumption, which, in turn, could have pushed the GDP growth rates. The RBI governor also said in his statement that they would have liked to see higher growth. “We will remain vigilant of the incoming data,” said Malhotra.

Benign food prices

The six-member MPC met between September 29 and October 1 and decided that this was the best way to move forward. During his briefing Malhotra also revised the growth rate upwards for the current financial year and said that inflation will continue to ease for the current financial year, mainly due to the benign food prices and stable core inflation. He also flagged a higher GDP growth rate in the current financial year, creating quite a sweet spot coupled with low inflation even as he cautioned about the headwinds of tariff and trade-induced US policies on the growth process.

Outlook on inflation

In his briefing in June, the RBI governor predicted price stability in the near and medium term, a better-than-normal southwest monsoon and robust crop performance. He put the inflation forecasts at 3.9% in Q1, 3.4% in Q2, 3.9% in Q3 and 4.4% in Q4. Today he indicated that the inflation rates could be 1.8% for Q2, 1.8% Q3, 4% for Q4 of FY26 while it could rise to 4.5% in Q1 of the next financial year (FY27)

GDP growth to accelerate

On June 6 Malhotra pegged the GDP growth forecast at 6.5% in FY26, which he revised upwards today. Breaking up the GDP growth rates between quarters, he said GDP could grow at 6.5% in Q1, 6.7% in Q2, 6.6% in Q3 and 6.3% in Q4.

Today he outlined the growth predictions for the next few quarters in the following way: 7% in Q2, 6.4% in Q3, 6.2% in Q4. The GDP growth will again rise to 6.4% in Q1 of the next financial year, he said. GDP could grow at 6.8% this year against the earlier projection of 6.5%.

Experts were sharply divided

Experts sharply differed in their opinions in the run-up to this MPC meeting. A majority of economists polled by Reuters thought that the central bank will stay away from a rate cut this time. But SBI Research said that RBI should go for a 25 basis-point rate cut to spur consumption. Inflation is already down to multi-year lows and the GST rejig will have a further cooling effect on it. This, SBI Research argued, makes the atmosphere conducive for a rate cut to trigger growth and consumption. Morgan Stanley went a step further. It said RBI could snip 25 basis points of the Repo rate not only in the September-October meeting, but also in the December meeting.