The analyst’s new price target of $490 implies a potential upside of about 11% from the stock’s closing price on Monday.

Canaccord analyst George Gianarikas on Tuesday raised the price target on Tesla (TSLA) to $490 from $333 while keeping a ‘Buy’ rating on the shares.

The analyst’s new price target of $490 implies a potential upside of about 11% from the stock’s closing price on Monday.

Data from 30 counties show that Tesla’s deliveries are rising, prompting Canaccord to increase its delivery estimates, the analyst told investors in a research note, according to TheFly.

After several quarters of weakening momentum, Tesla’s deliveries are experiencing a positive trend break, according to Canaccord. Furthermore, the firm anticipates Tesla will soon announce new electric vehicle models, which should bolster its global sales momentum.

The new models will help alleviate any post-Q3 “cliff” in the U.S. after federal electric vehicle tax credits go away, Canaccord believes. The firm also expects an improvement in Tesla’s momentum in the energy storage segment in addition to EVs.

Tesla is slated to announce third-quarter deliveries on Thursday. Investors are awaiting the numbers to determine if Tesla will continue or buck the trend of consecutive quarters of declining deliveries.

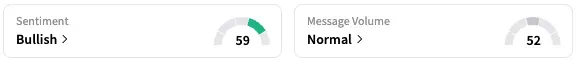

On Stocktwits, retail sentiment around TSLA stock stayed within the ‘bullish’ territory over the past 24 hours, while message volume stayed at ‘normal’ levels.

A Stocktwits user expressed optimism that the stock would touch new highs.

Yet another, however, sees the stock slipping back to $400.

Tesla deliveries declined in both the first and second quarters of this year. In the second quarter, Tesla delivered 384,122 units, representing a 13.5% year-over-year decline.

In the first quarter, Tesla reported deliveries of 336,681 units, marking a dip of nearly 13% from the corresponding quarter of 2024 and the company’s worst quarterly performance in at least two years.

TSLA stock is up by 10% this year and by approximately 69% over the past 12 months.

Read also: Draganfly Stock Surged 20% Pre-Market Today – Here’s Everything To Know About Its US Army Drone Contract

For updates and corrections, email newsroom[at]stocktwits[dot]com.<