Tata Investment surged 20% on a stock split and Tata Capital IPO buzz, while Indigo and Man Industries dragged.

Indian equity markets ended a choppy expiry session on a subdued note, with the Nifty index closing below 24,700. Benchmarks have closed lower for the eighth consecutive day ahead of the RBI’s rate decision due tomorrow.

On Tuesday, the Sensex closed 97 points lower at 80,267, while the Nifty 50 ended down 23 points at 24,611. Broader markets were subdued, with the Nifty Midcap and Smallcap indices ending flat.

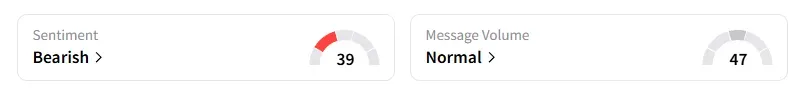

The retail investor sentiment surrounding the Nifty 50 remained ‘bearish’ by market close on Stocktwits.

Stock Moves

Sectorally, media, real estate, and consumer durables took a knock, while metals and PSU banks outperformed.

Hindustan Zinc surged 4% and Hindustan Copper gained 2% on the base metals rally.

Indigo was the top Nifty loser, ending 2% lower after being added to the index in the latest rejig. Meanwhile, Tata Motors ended over 1% higher ahead of its demerger, which takes effect on October 1.

Tata Investment shares ended 20% higher, hitting a fresh 52-week high following the announcement of a 1:10 stock split (record date: October 14) and as investors await the mega Tata Capital IPO, which is set to open next week.

Man Industries closed 10% lower after the market regulators barred the company and three top executives from the securities market for a period of two years.

And the new debutant, Anand Rathi Shares, ended 7% higher after listing with a 4% premium.

Stock Calls

SEBI-registered analyst Krishna Pathak believes Five Star Business is poised for a short-term breakout with upside target prices of ₹635, ₹710, and ₹777. The stock has been consolidating in a range, near its 9-week Exponential Moving Average (EMA) at ₹526, which is acting as strong support. Major resistance is seen around ₹55,0 and support near ₹448. Pathak flagged an accumulation opportunity between the ₹490–₹500 zone, which has shown visible buying interest in the past. A sustained move above ₹550 could unlock higher targets of ₹635–₹710 in the short term. But a breakdown below ₹448 may trigger a deeper correction.

Markets: What Next?

Ashish Kyal noted that the Nifty index has been respecting 24,580 levels and a major hurdle near the Gann magnet of 24,728. If it breaks out of the range of 24,580-24,740, it could provide a scalping opportunity in that direction.

Globally, European markets traded mixed, while US stock futures indicate a weak start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <