Michel Demaré, Chair of AstraZeneca, stated that enabling a global listing structure would allow the company to reach a broader mix of global investors and make it even more attractive to all its shareholders.

AstraZeneca (AZN) plans to list its ordinary shares on the New York Stock Exchange, replacing its existing U.S. listing of American Depositary Receipts (ADRs) on Nasdaq, the pharmaceutical giant announced on Monday.

The move is part of the company’s efforts to expand its access to capital, including in the U.S. Nasdaq-listed ADRs of the company traded 1% higher in the pre-market session at the time of writing.

Following the implementation of the new and harmonized listing structure, shareholders will be able to trade their interests in AstraZeneca ordinary shares across the London Stock Exchange (LSE), Nasdaq Stockholm (STO), and the New York Stock Exchange (NYSE), the company said.

Michel Demaré, Chair of AstraZeneca, stated that enabling a global listing structure would allow the company to reach a broader mix of global investors and make it even more attractive to all its shareholders, while remaining headquartered in the U.K. The plan will now be put to a vote on November 3.

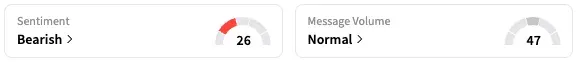

On Stocktwits, retail sentiment surrounding AZN stock remained within the ‘bearish’ territory while message volume stayed at ‘normal’ levels.

AstraZeneca stated that the U.S. has the world’s largest and most liquid public markets by capitalization. The new listing structure will not alter the company’s status as a U.K.-listed, headquartered, and tax-resident company, the company added.

In 2024, the United States accounted for 43% of AstarZeneca’s total revenue. The U.S. accounted for $23.23 billion in revenue while Europe accounted for 23% of total revenue, or $12.19 billion.

In July, the company also announced a $50 billion investment in the U.S. by 2030, which would include the expansion of its research and development facility in Maryland, as well as manufacturing facilities for cell therapy in Rockville, Maryland, and Tarzana, California, among others.

It had then stated that the investments would help it achieve its goal of reaching $80 billion in total revenue by 2030, with half of that revenue to be generated in the U.S. AZN shares are up by 13% this year but down by over 5% over the past 12 months.

Read also: US Regulator Closes Probe Into Stellantis’ 24,000 Alfa Romeo Giulia Vehicles

For updates and corrections, email newsroom[at]stocktwits[dot]com.<