BS noted that “Celebration Key” in the Bahamas, a recently opened private destination only for Carnival cruisers, was also generating interest.

Carnival Corp stock is on investors’ radar ahead of the cruise line operator’s quarterly report before the markets open on Monday, with analysts expecting smooth sailing.

Carnival has seen a string of price target hikes this month, and brokerages largely expect a beat-and-raise similar to the one in the last quarterly report in June.

At the time, the company raised its profit outlook for its current fiscal year, ending November 2025, and stated that its “affordable” cruise fares were attracting consumers during the summer holiday season.

Carnival has the potential to post a better-than-expected third-quarter net yield and a guidance raise on solid booking trends and early contributions from the “Celebration Key” destination in the Bahamas, UBS said in a Wednesday investor report.

Opened in July, Celebration Key in the Bahamas is Carnival’s first private destination, built exclusively for Carnival cruisers.

The investment research firm stated that booking volumes in July and August had grown “meaningfully,” while the company is seen to be benefiting from European sourcing, which is higher compared to its rivals.

Deutsche Bank expects Carnival to beat top and bottom-line estimates. Although the company is not expected to provide a formal 2026 outlook, it may issue intermediate-term goals.

According to Koyfin data, analysts expect the company to report a 2.7% rise in revenue and a 3.7% growth in adjusted earnings per share.

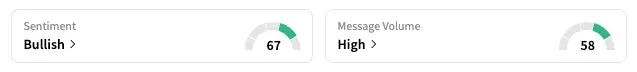

On Stocktwits, the retail sentiment for CCL has remained ‘bullish,’ unchanged over the past week.

“$CCL lower fuel costs, increased bookings, increased price targets, tons of room to run to get back anywhere near all-time highs,” a bullish user posted.

CCL stock is down about 6% from its lifetime high, which the stock hit on Aug. 28. Year-to-date, the shares are up 22%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<