Hertz plans to use $300 million of the net proceeds from a notes offering to fund the partial redemption or repurchase of its outstanding senior notes, primarily due in 2026.

Hertz Global (HTZ) stock jumped over 13% in premarket trading on Thursday after the car rental firm said its wholly owned indirect subsidiary intends to sell $375 million worth of senior notes in a private upsized offering.

The aggregate principal amount of the offering was raised from the previously announced $250 million. Hertz plans to use $300 million of the net proceeds from the issuance of the debt to fund the partial redemption or repurchase of its outstanding senior notes, primarily due in 2026. Hertz added that it plans to use a portion of the additional net proceeds to fund the costs associated with entering into additional capped call transactions.

The notes will bear interest at a rate of 5.500% per year, payable semi-annually in arrears on April 1 and Oct. 1 of each year, beginning on April 1, 2026. The notes will mature on Oct. 1, 2030, unless repurchased, redeemed, or exchanged in accordance with their terms before maturity.

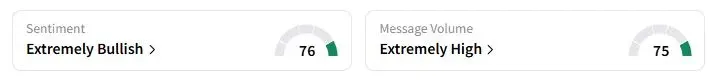

Retail sentiment on Stocktwits about Hertz was in the ‘extremely bullish’ territory at the time of writing.

The company had a net debt of $17.63 billion as of June 30, compared with $16.34 billion at the end of 2024.

Earlier this year, the company initiated negotiations to settle litigation regarding a significant payout of more than $300 million, which a federal appeals court had determined bondholders from the company’s 2020 bankruptcy were due.

“Looks good to continue uptrend,” one user said.

Hertz stock has gained nearly 88% this year. Bill Ackman’s Pershing Square Management acquired a 20% stake in the company in April, and Hertz launched a partnership with Amazon Autos last month, allowing shoppers to browse, finance, and purchase from a selection of thousands of pre-owned vehicles.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<