The analyst advised traders to watch for a break above ₹763, which could confirm the double bottom pattern and signal a change in trend to bullish.

JBM Auto’s electric vehicle arm has made a big move overseas. Its subsidiary JBM Electric Vehicles has teamed up with Al Habtoor Motors in the UAE. Under this deal, Al Habtoor becomes the exclusive distributor for JBM’s electric buses in the region.

JBM Auto stock surged 6% in morning trade, but pared the gains to trade 1% lower at the time of writing.

SEBI-registered analyst A&Y Market Research highlighted that the plan also includes city and school buses, airport coaches, tourist vehicles, as well as charging infrastructure and leasing services. The partnership aligns with the UAE’s Net Zero 2050 mission, with JBM projecting significant savings: 2.8 billion kg of CO₂ will be cut, 1 billion litres of diesel will be saved, and 1.6 billion passengers will be served over the next decade.

Why This Deal Matters

This partnership opens doors for JBM Auto to enter the UAE/GCC EV market with a credible partner. However, the analyst cautioned that it could put pressure on its margins, as EV buses require heavy R&D, service, and infrastructure support.

Additionally, execution and cash flow concerns weigh on sentiment as the company’s working capital is already stretched. There is intense competition in this space with global rivals such as BYD and Proterra also eyeing the GCC market.

According to A&Y Market Research, JBM Auto now has its foot in the door of a premium EV market. The future order wins in the Middle East and Africa now hinge on this project’s execution. Going ahead, delivery & margins will decide whether this becomes a real growth engine for JBM.

Technical Watch

They identified resistance at ₹763. The stock has formed a double bottom pattern on its charts, which signals a potential bullish reversal pattern. They advised traders to watch for a break above ₹763, which could confirm the double bottom pattern and signal a change in trend to bullish.

What Is The Retail Mood?

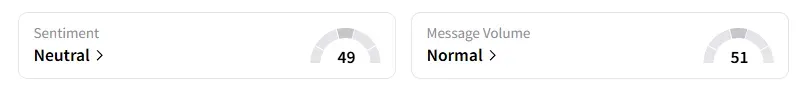

Data on Stocktwits shows that retail sentiment improved to ‘neutral’ from ‘bearish’ a week ago.

JBM Auto shares have declined 4% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<