The company announced that the trial will proceed without changes to evaluate the progression-free survival, overall survival, and safety endpoints.

Bristol Myers Squibb (BMY) announced on Tuesday that a late-stage study evaluating Iberdomide in patients with relapsed or refractory multiple myeloma demonstrated a statistically significant improvement in minimal residual disease (MRD) negativity rates compared to the control arm, when combined with standard therapies.

Minimal residual disease (MRD) refers to the small number of cancer cells that may remain in a patient’s body after treatment. MRD assessment has emerged as a highly sensitive and clinically meaningful tool for evaluating treatment response in multiple myeloma, a cancer of plasma cells in the bone marrow that leads to tumors in multiple bones, the company said.

While MRD negativity does not necessarily mean all cancer cells are gone, it may predict improved clinical outcomes, including longer remission and survival, it added.

The trial will now continue without changes to evaluate the progression-free survival (PFS), overall survival, and safety endpoints, the company said. Bristol Myers noted that it plans to discuss the results with health authorities.

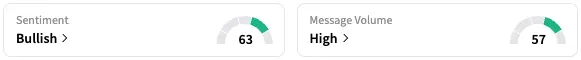

Shares of BMY traded marginally higher at the time of writing. On Stocktwits, retail sentiment surrounding BMY stock remained within the ‘bullish’ territory over the past 24 hours, while message volume rose from ‘normal’ to ‘high’ levels.

Earlier this month, BioNTech SE (BNTX) and Bristol Myers Squibb also presented interim data from a global randomized mid-stage trial evaluating their drug Pumitamig plus chemotherapy in patients with extensive-stage small cell lung cancer. The data showed encouraging anti-tumor responses, with a positive trend in progression-free survival, or the length of time a patient with a disease lives without it worsening.

According to Koyfin data, 19 out of 26 analysts covering Bristol-Myers stock rate it a ‘Hold’, six rate it ‘Buy’ or higher, while one rates it a ‘Sell.’ The average price target on the stock is $52, representing an upside of over 17% from current price levels.

BMY stock is down by about 20% this year and by about 10% over the past 12 months.

Read also: Moderna Says Updated mNEXSPIKE Covid Shot Demonstrated Robust Immune Response In Study

For updates and corrections, email newsroom[at]stocktwits[dot]com.<